Loading

Get Nm Es903 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM ES903 online

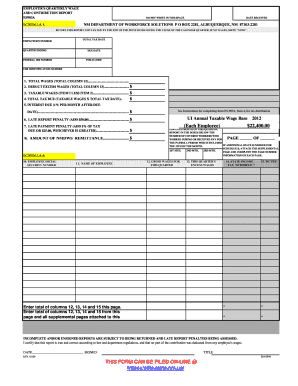

The NM ES903 form is an essential document for employers to report quarterly wages and contribution details. This guide provides a step-by-step approach to help you successfully fill out the form online.

Follow the steps to complete the NM ES903 form online.

- Click the ‘Get Form’ button to access the form and open it in your editor.

- Begin by entering your employer's number in the designated field. This is a unique identifier assigned to your business by the state.

- Fill in the quarter ending date. Be sure to specify the correct quarter for which you are reporting wages.

- Enter your Federal IRS number. This is required for tax identification purposes.

- Input your total tax rate. This is the percentage that will be applied to taxable wages to calculate the tax owed.

- Indicate the due date for this report. Remember that this is typically the end of the month following the close of the quarter.

- Enter the total wages in item 1, referring to column 12 of Schedule B.

- Deduct any excess wages in item 2, entering the total from column 13.

- Calculate the taxable wages by subtracting item 2 from item 1 and record the result in item 3.

- Determine the total tax due by multiplying the taxable wages from item 3 by the total tax rate. Record this amount in item 4.

- If applicable, calculate any interest due for late submissions at a rate of 1% per month after the due date, and enter this in item 5.

- Add any applicable late report penalty of $50.00 in item 6.

- Calculate the late payment penalty for either 5% of the tax due or $25.00, whichever is greater, and enter this in item 7.

- In item 8, state the total amount of the remittance you are sending to the New Mexico Department of Workforce Solutions.

- Proceed to Schedule B, where you will list each employee's Social Security number and their respective names, along with gross wages and other related details.

- Complete all required fields and ensure the accuracy of the information provided.

- Once all sections are filled out, review the form for completeness and compliance.

- Save any changes made, then choose to download, print, or share the completed form as needed.

Start filling out your NM ES903 form online today to ensure compliance and timely submission.

Related links form

NM unemployment benefits are calculated based on your highest earning quarters during your base period. The state will review your work history and earnings to determine the amount you are eligible to receive. It’s important to report accurate income to ensure you receive the correct benefit amount. Understanding how this calculation works helps in planning your finances while you seek new employment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.