Loading

Get Ca De 9adj 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DE 9ADJ online

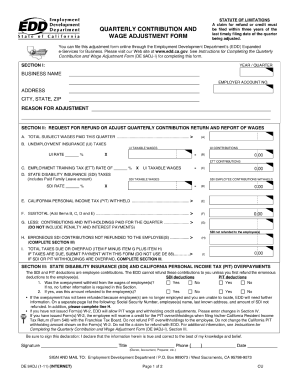

Filling out the CA DE 9ADJ form online can facilitate accurate quarterly contribution and wage adjustments. This guide provides a comprehensive walkthrough to help you complete the necessary sections efficiently and effectively.

Follow the steps to complete the CA DE 9ADJ online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin by filling out Section I, which includes the year and quarter, business name, employer account number, address, city, state, zip code, and the reason for adjustment. Ensure all information is accurate.

- In Section II, provide adjustments to wages and contributions. Fill in the amounts for previously reported figures versus what should have been reported. Ensure you input any differences accurately.

- Complete the specific fields for unemployment insurance taxable wages, state disability insurance taxable wages, employer’s UI contributions, and employment training tax. Be sure to calculate totals accurately.

- Review penalties and interest sections, referencing the provided instructions for these calculations if necessary.

- If applicable, fill in Box 1 and Box 2 which address state disability insurance and personal income tax overpayments. Follow the instructions for determining if credits have been refunded to employees.

- Conclude by signing the declaration to affirm that the information provided is true and correct. Fill in your title, date, and contact number.

- Finally, save any changes made, and utilize options to download, print, or share the completed form as needed.

Complete your CA DE 9ADJ form online today for streamlined processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing an unemployment tax return involves completing the DE9 form accurately and submitting it to the EDD. It is vital to report all employee wages appropriately to comply with the CA DE 9ADJ rules. To streamline the process, consider using uslegalforms, which offers user-friendly solutions tailored for employers like you, ensuring accurate and timely submissions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.