Loading

Get Ky F1120 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY F1120 online

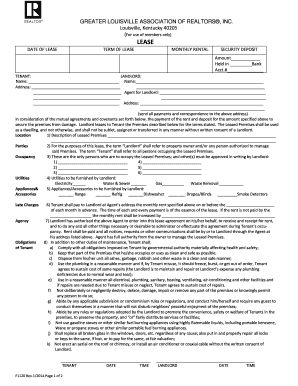

Completing the KY F1120 form online is a straightforward process that allows users to manage their leasing agreements effectively. This guide provides clear instructions to ensure proper filling out of each section of the form.

Follow the steps to complete the KY F1120 form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Fill in the date of lease at the top of the form. Ensure you enter the exact date the lease agreement begins.

- Enter the term of the lease by specifying the duration (months, years) of the agreement.

- Provide the monthly rental amount, ensuring it reflects the agreed-upon rent.

- Specify the security deposit amount and the bank where it will be held, including the account number.

- Complete the tenant section by writing the full name and address of the tenant.

- Fill in the landlord section, including the name and address of the landlord or property manager.

- In the description of the leased premises, provide thorough details about the property being rented.

- List the occupants who will be living in the leased premises, ensuring to include each person's name.

- Indicate the utilities that will be provided by the landlord by checking the appropriate boxes.

- List any appliances or accessories that the landlord will provide as part of the lease.

- Outline the obligations of the tenant regarding payment of rent, maintenance, and other responsibilities as specified in the lease.

- Review the lease for any additional clauses, alterations needed, or information pertaining to security deposits.

- Once all information has been filled out correctly, save the changes, then download or print the lease for signatures.

- Ensure that both parties sign and date the document to validate the lease agreement.

Complete your lease agreements accurately by filling out your documents online today.

Individuals who earn income from Maryland sources while residing in another state must file a nonresident return in Maryland. This is important for compliance and to ensure proper tax reporting. If your business activities involve Maryland, understanding this requirement can help in proper tax planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.