Loading

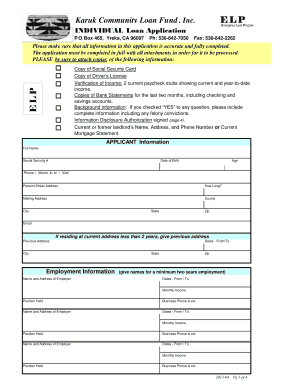

Get Karuk Community Loan Fund Inc E L P - Kclf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Karuk Community Loan Fund Inc E L P - Kclf online

Filling out the Karuk Community Loan Fund Inc E L P - Kclf online application is a straightforward process designed to help you secure the necessary funding. This guide provides clear, step-by-step instructions to ensure your application is completed accurately and efficiently.

Follow the steps to complete your application smoothly.

- Click ‘Get Form’ button to obtain the application form and open it in the editor.

- Gather the required documents. Ensure you have the following items readily available: a copy of your Social Security card, a copy of your driver's license, verification of income (two current paycheck stubs), bank statements for the last two months, complete background information (if applicable), an Information Disclosure Authorization (page 4), and details of your current or former landlord.

- Begin filling out the applicant information section. Enter your full name, Social Security number, date of birth, age, phone numbers (home and/or cell), present street address, mailing address, county, city, state, zip code, and email address. If you have lived at your current address for less than 2 years, provide your previous address and the dates you resided there.

- Complete the employment information section. List the name and address of your employer(s), the dates of employment, your position held, monthly income, and business phone number. Provide information for at least two years of employment.

- Detail your income information. List all sources of income, including wages, self-employment, child support, and any other financial contributions. Be sure to include the gross monthly amount for each source and remember to attach verification for every income source listed.

- Fill out the liabilities information. List all debts, including car payments, outstanding debts, and creditors. Provide the name of the entity you owe and the monthly payment amount for each liability.

- Complete the checking/savings accounts section. Indicate the bank, whether the account is checking or savings, account number, and balance for each account you hold.

- For homeowners, provide information about your property. Include the address, current market value, amount owed, and your monthly payment.

- Clearly state the nature of your request for the loan and specify the amount requested.

- Answer the declarations of applicant section by indicating 'yes' or 'no' to questions about outstanding judgments, bankruptcy, foreclosures, lawsuits, debt delinquencies, and obligations to pay alimony or child support.

- Indicate your tribal affiliation and race/national origin as applicable.

- Review your application to ensure all information is accurate and complete. Sign and date the application, acknowledging the truth of the information provided.

- Final review: ensure that all required attachments are included, then save changes, download, print, or share the completed form as necessary.

Take the next step in securing your loan by completing the application online today!

Microsoft Office 365 provides various software solutions such as SharePoint, Microsoft Dynamics and OneDrive for document management that have unique perks based on their application and your needs. However, each offers you; Easy access to the information you want.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.