Loading

Get Centre County Application For Homestead And Farmstead

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CENTRE COUNTY APPLICATION FOR HOMESTEAD AND FARMSTEAD online

Filling out the Centre County Application for Homestead and Farmstead online is a straightforward process that can help reduce your property tax burden. This guide will provide step-by-step instructions to ensure you complete the application accurately and efficiently.

Follow the steps to complete the application online.

- Click the ‘Get Form’ button to access the application form and open it in an editor.

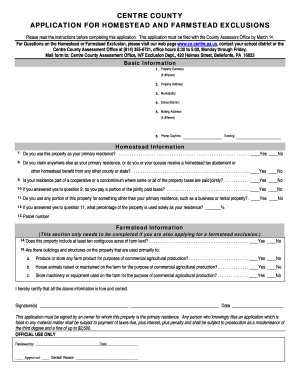

- Provide basic information about the property owner(s), including full name, property address, municipality, and school district. Make sure to fill in the mailing address if it differs from the property address.

- Enter your daytime and evening phone numbers where you can be reached.

- Indicate whether you use the property as your primary residence by selecting 'Yes' or 'No'.

- Confirm if you claim another property as your primary residence or receive homestead benefits from another county or state.

- Specify if the property is part of a cooperative or condominium where taxes are paid jointly, and indicate if you pay a portion of these taxes.

- Describe if any part of this property is used for non-residential purposes, such as a business or rental, and provide the percentage used solely as your residence if applicable.

- For farmstead exclusions, confirm if the property includes at least ten contiguous acres of farmland and detail the primary use of any buildings or structures on the farm.

- Review all the information you've entered to ensure accuracy, then proceed to sign and date the application.

- Once completed, save your changes, and choose to download, print, or share the application as needed.

Start your application online to benefit from potential tax reductions.

Pennsylvania will continue its broad-based property tax relief in 2022-23 based on Special Session Act 1 of 2006.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.