Loading

Get Life Policy Administration And Disbursement Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LIFE POLICY ADMINISTRATION AND DISBURSEMENT REQUEST FORM online

Filling out the LIFE POLICY ADMINISTRATION AND DISBURSEMENT REQUEST FORM online can streamline the process of managing your life insurance policies. This guide will walk you through each section of the form to ensure that you complete it accurately and efficiently.

Follow the steps to fill out the form successfully.

- Press the ‘Get Form’ button to download the LIFE POLICY ADMINISTRATION AND DISBURSEMENT REQUEST FORM. This will open the document in your preferred editor allowing you to fill it out digitally.

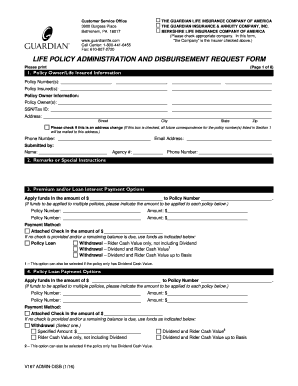

- In the first section, provide your policy owner and life insured information, including policy numbers and the names associated with the policies. Ensure all details are accurate as this is crucial for identification.

- Next, enter the policy owner's contact information including Social Security Number or Tax ID, address, and email. If this is a new address, check the box indicating an address change.

- In the remarks or special instructions section, you can add any relevant notes or instructions that may assist in processing your request.

- Proceed to the premium and/or loan interest payment options. Specify the amount of funds to be applied to different policy numbers and the chosen payment method—either attaching a check or selecting a withdrawal option.

- Continue filling out the policy loan payment options if applicable. Indicate the amount and method of applying funds similar to the previous step.

- Select options for the automatic premium loan provision and the mode of payment—annual, semi-annual, quarterly or monthly. Make sure to note any additional amounts required.

- Complete the section on dividend option changes, specifying how you wish your dividends to be used, whether as cash, paid-up additions, or otherwise.

- In the nonforfeiture options section, specify whether you wish to opt for paid-up extended term insurance or reduced paid-up insurance.

- Provide your signature in the final section, confirming that all information is accurate and that you understand the implications of your requests. Ensure all required parties sign where applicable.

- Once you have completed the form, review all entries for accuracy before saving. You can download a copy for your records, print the document, or share it with necessary parties.

Start completing your documents online today for a more efficient processing experience.

Can you cash out a life insurance policy before death? If you have a permanent life insurance policy, then yes, you can take cash out before your death. There are three main ways to do this. First, you can take out a loan against your policy (repaying it is optional).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.