Loading

Get State Of Washington Scan Review Petition Form - Dor Wa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of Washington Scan Review Petition Form - Dor Wa online

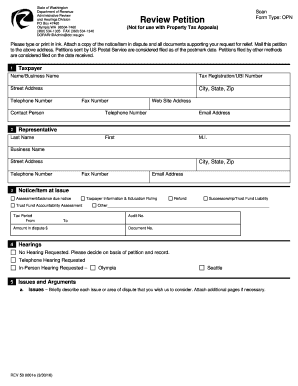

Filling out the State Of Washington Scan Review Petition Form - Dor Wa can seem daunting, but this guide will provide clear and supportive instructions. By following these steps, you can efficiently complete and submit your petition online.

Follow the steps to fill out your Scan Review Petition Form correctly.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by filling in the taxpayer information section. Include the name or business name, tax registration number or UBI number, street address, city, state, and zip code. Ensure that this information is accurate and complete.

- Next, provide your contact details. This includes your telephone number, fax number, and email address. If applicable, list the name and contact information of your representative.

- In the notice/item at issue section, select the relevant type of assessment or notice you are disputing. Be sure to include the audit number and tax period along with the amount in dispute.

- Indicate your hearing preferences. You can select 'No Hearing Requested' or choose between a telephone or in-person hearing. Specify your preference clearly.

- In the issues and arguments section, briefly describe each issue you wish to dispute. Attach additional pages if necessary. Then, provide your arguments explaining why the matters should be decided in your favor, including any relevant rules or statutes.

- In the signature section, either the taxpayer or the representative can sign the petition. Ensure to check if you permit communication via email or fax and understand the associated risks. Include your printed name and title.

- Once all sections are completed, review the form for accuracy, then save your changes. You can now download, print, or share the completed form as needed.

Complete your documents online today for a seamless experience.

A Nebraska tax power of attorney (Form 33), otherwise known as the Nebraska Department of Revenue Power of Attorney, is a document that can be used to designate a tax professional to represent your interests with the Department of Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.