Loading

Get Computershare W 8ben

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Computershare W 8ben online

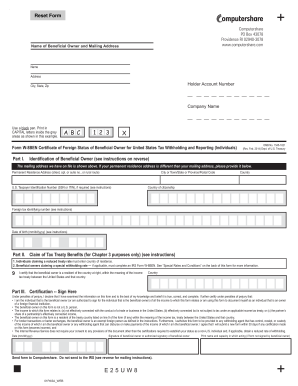

Filling out the Computershare W 8ben form is an essential step for individuals who need to certify their foreign status for U.S. tax withholding. This guide will walk you through each section of the form in a clear and straightforward manner, ensuring a user-friendly experience.

Follow the steps to effectively complete the Computershare W 8ben form online.

- Press the ‘Get Form’ button to obtain the W 8ben form and access it in your online platform.

- Enter your name in the provided field. This should match the name associated with your beneficial ownership.

- Include your Holder Account Number, which is necessary for identification in your account with Computershare.

- If your permanent residence address is different from your mailing address, enter it in the specified section.

- Provide your U.S. Taxpayer Identification Number (SSN or ITIN) if required; if not applicable, you may leave this blank.

- Indicate your country of citizenship, ensuring that it reflects your current status.

- Enter your Foreign Tax Identifying Number, if available, following the instructions in the form.

- Fill in your date of birth in the correct format (mm/dd/yyyy) as requested in the form.

- Complete Part II by certifying your country of residence in relation to tax treaty benefits. If applicable, check the relevant boxes.

- Proceed to sign and date the form. Ensure your signature is included, as an unsigned form may be considered invalid.

- Finally, save your changes, download, print, or share your completed form as needed.

Complete your W 8ben form online today to ensure timely certification and compliance.

How to fill the W-8BEN-E form? Name of your organization. Country of incorporation of your organization. Name of a disregarded entity, receiving the payment. Your Entity Chapter 3 Status. Your entity FATCA status. Permanent residence address. 7.Mailing address. 8,9,10 – Tax Identification Information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.