Loading

Get Ks Vs-220 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS VS-220 online

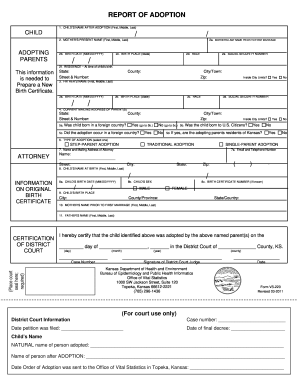

The KS VS-220 form is essential for reporting an adoption in Kansas. This guide provides clear and detailed instructions for filling out the form accurately to help ensure a smooth process.

Follow the steps to complete the KS VS-220 form online.

- Click ‘Get Form’ button to access the form online and open it in the editor.

- Begin by filling in the child’s name after adoption in the designated fields for first, middle, and last names.

- Provide the mother's present name in the specified sections, along with her birth date, last name prior to first marriage, birth place, race, and social security number.

- Indicate the mother's residence at the time of the child’s birth by entering the state, street address, county, city/town, and zip code.

- Fill out the father's name and related details, including his birth date, place, race, and social security number.

- Enter the current mailing address of the adopting parents, including the street address, county, city/town, state, and zip code.

- Answer the questions regarding the child’s birth and adoption place, selecting yes or no as appropriate, and indicate if the child was born to U.S. citizens.

- Select the type of adoption from the provided options: step-parent adoption, traditional adoption, or single-parent adoption.

- Provide the name and mailing address of the attorney handling the adoption, including their email and telephone number.

- Complete the section for the child's name at birth, including first, middle, and last name, along with the birth date and sex.

- Fill in the child's birth place, including city, county/province, and state/country.

- Provide the mother's name prior to first marriage and the father's name as required.

- Certify the adoption details by providing the district court’s certification, including the date and county, along with the signature of the district court judge.

- Review all entered information for accuracy. Once confirmed, users can save changes, download, print, or share the completed form.

Complete your KS VS-220 form online today to ensure a seamless adoption process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To elect S Corporation status, you must file IRS Form 2553. This form enables your corporation to be taxed as an S Corporation rather than a standard corporation, allowing for pass-through taxation. It is essential to file this form correctly and on time to gain the benefits of S Corp status. Leverage KS VS-220 to help navigate this process effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.