Loading

Get Credit Application With Personal Guarantee

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Application With Personal Guarantee online

Completing the Credit Application With Personal Guarantee online is a straightforward process. This guide provides you with clear instructions to help you navigate each section of the form effectively.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

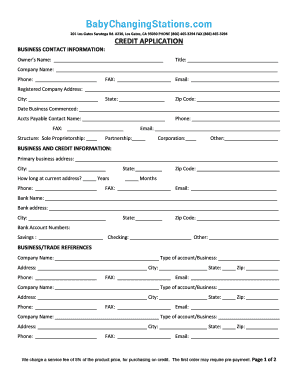

- Begin by filling in the business contact information. Enter the owner’s name, title, company name, phone number, fax number, and email. Ensure all fields are accurately completed.

- Provide the registered company address, including city, state, and zip code. Additionally, indicate the date the business commenced.

- Next, complete the accounts payable contact information. This includes a contact name, fax number, phone number, and email address. Specify the structure of the business by indicating whether it is a sole proprietorship, partnership, corporation, or other.

- In the business and credit information section, enter the primary business address, city, state, and zip code. Specify how long the business has been at the current address by filling in the years and months. Include the primary business phone number, fax number, and email address.

- List the bank details, including the bank name, bank address, city, state, and zip code. Fill in the bank account numbers for savings, checking, and any other accounts as applicable.

- Provide three business or trade references by filling in their names, types of accounts, addresses, cities, states, zip codes, phone numbers, fax numbers, and email addresses.

- Read and understand the personal guarantee section. Fill in your signature, printed name, home address, city, state, zip code, and social security number if you are the first guarantor. Repeat this for the second guarantor if applicable.

- Once all sections are complete, review the form for accuracy. You can then save your changes, download, print, or share the form as needed.

Complete your documents online today for a smoother application process.

Related links form

Personal guarantees don't have a direct impact on your personal or business credit history, or credit score unless you run into trouble. "They don't typically show up on credit reports," Luebbers says. But, a personal guarantee could affect your credit if you have late payments or default on the loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.