Loading

Get Uniform Transfers To Minors Act (utma) Athene Annuity &amp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UNIFORM TRANSFERS TO MINORS ACT (UTMA) Athene Annuity online

Filling out the UNIFORM TRANSFERS TO MINORS ACT (UTMA) form for Athene Annuity can be straightforward with the right guidance. This comprehensive guide will walk you through each section of the form, ensuring a smooth completion process.

Follow the steps to fill out the form accurately and efficiently.

- Press the ‘Get Form’ button to access the form and open it in your digital editor.

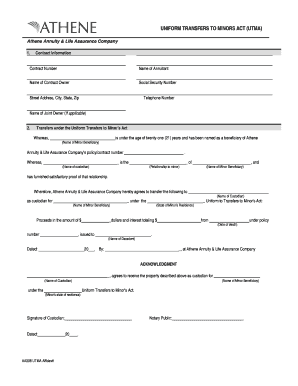

- Complete the contract information section by entering the contract number, name of the annuitant, name of the contract owner, social security number, and full address including street, city, state, and zip code. Don’t forget to add your telephone number and the name of any joint owner if applicable.

- In the transfers section, input the name of the minor beneficiary who is under the age of twenty-one years in the provided field. Make sure to reference the specific policy or contract number from Athene.

- Identify the custodian responsible for managing the funds. You will need to provide their name, relationship to the minor, and confirm that satisfactory proof of this relationship has been supplied.

- Enter the amount to be transferred for the minor beneficiary, which includes the proceeds and any applicable interest totals. Ensure you provide the correct numerical values and the state of residence for the minor to comply with local regulations.

- Complete the acknowledgment section where the custodian agrees to receive the property described. The custodian must sign and date the form, ensuring all information is accurate and up to date.

- Lastly, it is important to have the signature of a notary public for validation of the form. This should be done on the relevant date.

- Once you have filled out all required fields, save your changes, and decide whether to download, print, or share the document as necessary.

Complete the UNIFORM TRANSFERS TO MINORS ACT (UTMA) form online today for a hassle-free experience.

When the minor beneficiary of an UTMA custodial account reaches the age of majority, the custodianship is over, and they get legal control over everything that's in the account. It's important to note that the age of majority is slightly different in each state. In most cases, it's either 18 or 21.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.