Get Sls Mortgage Assistance Application Checklist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SLS Mortgage Assistance Application Checklist online

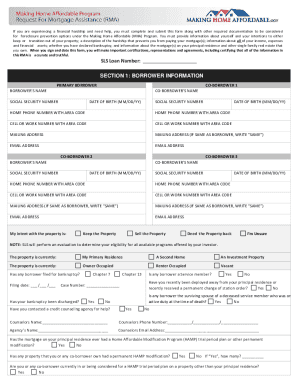

This guide provides step-by-step instructions to help you effectively complete the SLS Mortgage Assistance Application Checklist online. Follow these guidelines to ensure that your application is submitted accurately and promptly.

Follow the steps to complete your application checklist.

- Click ‘Get Form’ button to access the SLS Mortgage Assistance Application Checklist and open it in the online editor.

- Review the information provided to understand your options, responsibilities, and next steps regarding foreclosure prevention.

- Complete and sign the enclosed Request for Mortgage Assistance Form (RMA).

- Provide the required hardship documentation.

- Submit the income documentation needed to support your application.

- Finalize your application package by ensuring you have completed all required documents listed in steps 2-5.

- Send your completed application package to SLS.

- After submitting, monitor your application status.

Complete your SLS Mortgage Assistance Application Checklist online today to take the first step towards financial relief.

Related links form

While mortgage forbearance can provide essential relief, it often comes with certain downsides. For instance, once the forbearance period ends, you typically must repay the postponed amounts, which can create a financial burden. Using the SLS Mortgage Assistance Application Checklist can help you weigh your options and understand these implications fully. Awareness and planning can make a significant difference in how you navigate this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.