Get Tsp-17 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP-17 online

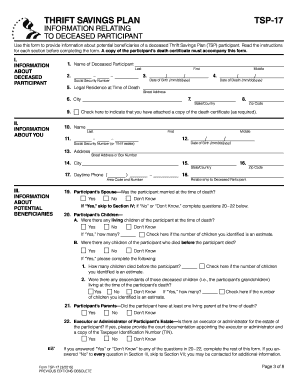

Filling out the TSP-17, Information Relating to Deceased Participant, is an important step in managing the benefits of a deceased participant's Thrift Savings Plan account. This guide provides comprehensive, user-friendly instructions to ensure you accurately complete the form online.

Follow the steps to successfully fill out the TSP-17.

- Press the ‘Get Form’ button to acquire the TSP-17 and open it in the editor.

- Begin with Section I, providing complete information about the deceased participant, including their name, Social Security number, date of birth, and legal residence at the time of death. Ensure to attach a copy of the death certificate that states the cause or manner of death.

- Move to Section II to enter your information. If you are not a potential beneficiary, you may leave the Social Security number and date of birth blank. If you are the executor or administrator of the estate, indicate your role in Item 18.

- In Section III, answer whether the participant was married at the time of death. Depending on your answer, provide information about potential beneficiaries such as children, parents, or the estate administrator.

- If necessary, proceed to Section IV to provide detailed information about potential beneficiaries, ensuring to list their names, relationships, and contact information. Use additional pages if you have more than four beneficiaries.

- If you do not have complete information for potential beneficiaries, complete Section V with the contact information of someone who may assist in obtaining this information.

- Use Section VI for any additional information relevant to the deceased participant’s account and that was not covered elsewhere.

- Finally, sign and date the form in Section VII to certify that the information is accurate to the best of your knowledge.

- After completing the form, save any changes, print a copy for your records, and submit the original form along with the death certificate to the appropriate TSP address.

Start completing your TSP-17 online today to ensure timely processing of benefits.

Related links form

Reporting your TSP on taxes involves including information about contributions, withdrawals, and any other relevant details on your tax return. Specifically, report any distributions as income for the year you received them. The information required will typically be available on your annual TSP statement. If you need assistance with the reporting process, consider reaching out to a qualified tax professional for help.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.