Loading

Get Form 518

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 518 online

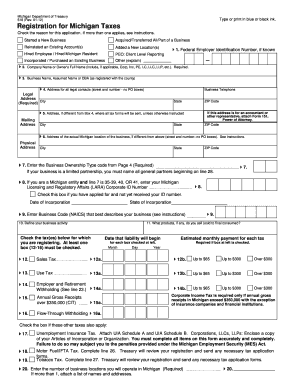

Filling out Form 518 online can streamline the registration process for Michigan business taxes. This guide offers a clear, step-by-step approach to help you complete the form accurately and efficiently, ensuring you meet all necessary requirements.

Follow the steps to accurately complete Form 518 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate the reason for completing the application by checking the corresponding box, ensuring you select all that apply.

- Enter your Federal Employer Identification Number (FEIN) if known in Line 1. If you need an FEIN, contact the IRS or follow the provided instructions.

- In Line 2, provide the company name or the owner's full legal name, including any applicable designators such as LLC or Corp.

- Complete Line 4 with your legal address where business records are maintained. Ensure this address can receive official mail.

- If your mailing address differs from the legal address, specify it in Line 5.

- Fill in Line 6 with your physical address if it is different from your legal address.

- Select the business ownership type code in Line 7 from the provided list that best describes your business structure.

- If applicable, provide your Michigan Licensing and Regulatory Affairs (LARA) Corporate ID Number in Line 8.

- On Line 9, enter the six-digit North American Industry Classification System (NAICS) code that accurately reflects your business.

- Describe the specific business activity in Line 10. This should succinctly explain what services or products your business will engage in.

- In Line 11, indicate the types of products you will sell to consumers.

- From Lines 12 to 16, check the applicable tax types you will be liable for and specify when your liability for each tax will begin.

- If applicable, complete the Unemployment Insurance Tax section in Line 17 and submit the necessary schedules.

- Enter the total number of business locations in Line 20 and your fiscal year closing month in Line 21.

- If your business operates seasonally, indicate the months in which your business is open in Line 22.

- If you use a payroll service, check the box in Line 23 and provide the name of the service.

- Provide the names and account numbers of any existing businesses you may be incorporating or merging with in Line 24.

- Ensure that you complete the section for each owner or partner, listing at least one name in Lines 28 to 31.

- Review all entries for accuracy, then sign and date the form to certify that the information provided is correct.

- Finally, submit the completed form by following the specified mailing or fax instructions.

Complete your Form 518 online today to ensure your business is properly registered for Michigan taxes.

The online registration eliminates the need to complete and mail in the 'Form 518, Michigan Business Tax Registration' booklet. After completing this on-line application, you will receive a confirmation number of your electronic submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.