Loading

Get Dependent Care Flexible Spending Account Account Rules And Claim...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dependent Care Flexible Spending Account account rules and claim online

Filling out the Dependent Care Flexible Spending Account claim form online can simplify the reimbursement process for eligible dependent care expenses. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete your claim form online.

- Press the ‘Get Form’ button to access the Dependent Care Flexible Spending Account claim form and open it in your chosen editor.

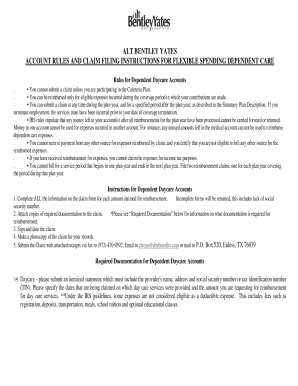

- Carefully complete all required fields on the claim form, including your name, social security number, mailing address, and email address. Ensure that no fields are left blank, as incomplete forms will be returned.

- Attach copies of the necessary documentation to support your claim. Required documentation includes itemized statements from the daycare provider, which must contain their name, address, tax identification number, the dates services were provided, and the claimed amount.

- Review your completed claim form for accuracy, and then sign and date the form to certify the information provided.

- Make a photocopy of the completed claim for your personal records before submission.

- Submit the claim along with the attached receipts via fax to (972) 470-9392, email to claims@abybenefits.com, or mail it to P.O. Box 520, Euless, TX 76039. Ensure that the claim is submitted on time to be processed in the next reimbursement cycle.

Start filling out your claim form online today to ensure timely reimbursement for your dependent care expenses.

You can pay many of your Dependent Care expenses directly from your FSA account, with no need to fill out paper forms or send in receipts. It's quick, easy, secure, and available online at any time. To pay a provider: Log into your FSA account or use the unique account url provided by your employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.