Loading

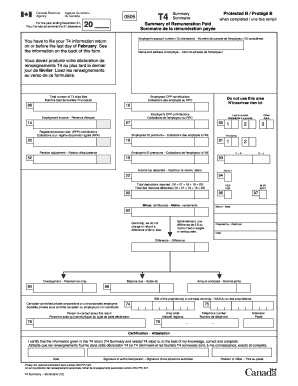

Get Canada T4 Summary 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T4 summary online

The Canada T4 summary is an essential document for employers to provide a summary of remuneration paid and taxes withheld for their employees. This guide will walk you through the process of filling out the T4 summary online effectively and accurately.

Follow the steps to fill out the Canada T4 summary online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer's account number, which consists of 15 characters. Make sure this matches the account number shown on your PD7A remittance form.

- Provide the name and address of the employer in the designated fields.

- Input the total number of T4 slips filed for the year. This is the number of individual T4 slips submitted for employees.

- Fill in the total employment income amount—this should reflect the total earnings before deductions.

- Report the total deductions, including employees' Canada Pension Plan contributions, Employment Insurance premiums, and any income tax deducted.

- If applicable, include amounts for the employer's contributions to CPP and EI.

- Complete any additional fields relevant to pension adjustments or other deductions.

- Once you have filled out all sections, review the information for accuracy.

- Save your changes and choose whether to download, print, or share the form according to your preferences.

Complete your Canada T4 summary online now to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

No, the T4 and W2 forms are not the same, though they serve similar purposes in their respective countries. The T4 form is used in Canada to summarize an employee's earnings and deductions, while the W2 form is utilized in the United States for similar reporting. If you’re navigating tax documents, knowing the difference between these forms is vital for clarity in your financial reporting.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.