Loading

Get Wage Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wage Form online

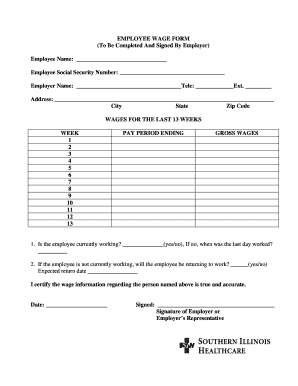

This guide provides a clear and supportive overview for completing the Wage Form online. Whether you are the employer or preparing the documentation for an employee, this step-by-step approach will help ensure all necessary information is accurately provided.

Follow the steps to complete the Wage Form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employee's name in the designated field at the top of the form. This information is essential for identifying the individual associated with the wage documentation.

- Input the employee's Social Security Number in the provided field. Ensure that this number is accurate to avoid any processing issues.

- Complete the employer's name and contact information, including telephone number and extension. This allows for direct communication regarding the wage details.

- Fill in the address of the employer, ensuring to include the city, state, and zip code. This ensures the form is properly attributed to the respective employer.

- For each of the subsequent weeks, fill in the gross wages earned by the employee over the last 13 weeks in the 'Wages for the last 13 weeks' section. It is critical to keep all wage entries correct for accurate reporting.

- Indicate whether the employee is currently working by selecting 'yes' or 'no' and provide the last day worked if applicable. This information is crucial for tracking the employee's status.

- If the employee is not working, note whether they will be returning to work and provide the expected return date if applicable.

- Once all sections are filled out accurately, review the information to ensure it is true and correct.

- Finally, date the form and have the employer or employer's representative sign it to certify the accuracy of the wage information.

- After completion, save your changes, and consider downloading, printing, or sharing the form as necessary to meet your filing requirements.

Complete your documents online today for a streamlined process.

Related links form

Anyone required to file Form W-2 must also file Form W-3, Transmittal of Wage and Tax StatementsPDF to transmit Copy A of Form W-2 to the SSA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.