Loading

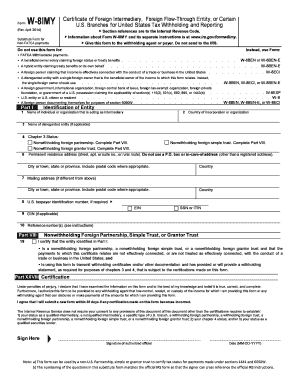

Get Substitute Form W-8 Imy - Created By Compliance Technologies International Llp Certificate Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Substitute Form W-8 IMY - Created By Compliance Technologies International LLP Certificate Of online

Filling out the Substitute Form W-8 IMY is a crucial process for entities acting as intermediaries in transactions that are subject to U.S. tax withholding. This guide provides clear, step-by-step instructions to help users navigate the form and ensure compliance with U.S. tax regulations.

Follow the steps to accurately complete the Substitute Form W-8 IMY online.

- Press the 'Get Form' button to access the substitute form and open it in your preferred editor.

- Begin with Part I, where you will provide the identification information of the entity acting as the intermediary. Fill in the name of the organization or individual in the first field.

- If applicable, provide the name of the disregarded entity in the second field.

- Complete the third field by entering the country of incorporation or organization.

- Select the chapter 3 status from the options available (e.g., nonwithholding foreign partnership) and ensure to complete Part VIII accordingly.

- Enter the permanent residence address in the designated fields, ensuring not to use a P.O. Box. Include the city, state, and postal code.

- If the mailing address is different from the permanent address, fill in the relevant details in the next section, including city, state, and postal code.

- Provide the U.S. taxpayer identification number if required, along with any GIIN applicable.

- In Part VIII, certify that the entity is a nonwithholding foreign partnership, simple trust, or grantor trust and provide the necessary certifications related to chapters 3 and 4.

- Finally, sign and date the form in the certification section, affirming that all information provided is true and complete.

- After filling out the form, you can save your changes, download, print, or share the document as necessary.

Complete your forms online to ensure timely and accurate submissions.

W-8BEN An individual who is not a tax resident in the US and is the beneficial owner of income. Not relevant for entities. W-8BEN-E An entity that is not a resident within the US for tax purposes and is the beneficial owner of income. W-8IMY An entity acting as an Intermediary or flow-through.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.