Loading

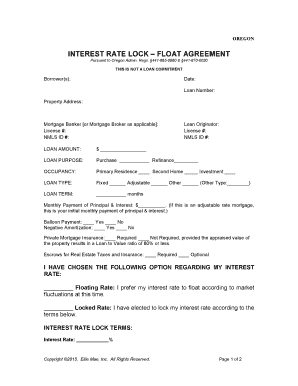

Get Or-eng-interest Rate Lock - Float Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR-ENG-INTEREST RATE LOCK - FLOAT AGREEMENT online

Filling out the OR-ENG-INTEREST RATE LOCK - FLOAT AGREEMENT correctly is essential for securing your interest rates during your mortgage process. This guide will highlight each component of the form, ensuring you have a clear understanding of what is required for successful completion.

Follow the steps to accurately complete the form

- Click 'Get Form' button to obtain the form and open it in the online editor.

- Enter the borrower(s) name in the designated field, ensuring correct spelling and capitalization. This should reflect the individual(s) applying for the loan.

- Fill in the date field, indicating the day you are completing the agreement. This date is crucial for tracking the lock-in period.

- Input your loan number if applicable. This number helps in identifying your specific loan application.

- Provide the property address where the loan will be applied. Make sure to include the complete address for clarity.

- Enter the mortgage banker or broker's name, along with their license number and NMLS ID. This establishes the credibility of the lending party.

- Fill in the loan originator's name, license number, and NMLS ID to maintain a transparent lending process.

- Specify the loan amount by filling in the designated blank. Ensure that this amount matches your intended mortgage request.

- Indicate the loan purpose by selecting either purchase or refinance. Check the appropriate box to reflect your intention.

- Select your occupancy status by marking one of the options: primary residence, second home, or investment.

- Choose the loan type that best describes your mortgage needs: fixed, adjustable, or other. If selecting other, specify the type in the provided space.

- Input the loan term in months, reflecting the duration of the mortgage agreement.

- Fill in the monthly payment of principal and interest if this is an adjustable-rate mortgage; otherwise, leave it blank.

- Indicate if a balloon payment or negative amortization applies to your loan.

- State if private mortgage insurance is required based on the loan-to-value ratio.

- Mark your choice regarding the interest rate by selecting either floating or locked rate.

- Specify the interest rate if you choose to lock in your rate.

- Fill in the expiration date of your lock-in agreement, ensuring it aligns with your loan closing timeline.

- If applicable, input the margin, index value, and description for adjustable-rate mortgages.

- Complete the lock-in fee section by stating the amount and date it must be paid.

- Review all information for accuracy and completeness, ensuring no spaces are left blank.

- Sign and date the document alongside any co-borrowers to validate the agreement.

- Once complete, save the changes, download, print, or share the agreement as needed.

Complete your OR-ENG-INTEREST RATE LOCK - FLOAT AGREEMENT online today for a smoother mortgage process.

A float-down option gives borrowers the opportunity to take advantage of lower interest rates if you've already locked your mortgage rate. Lenders have rules regarding how and when you can use the option to float the rate down. Most lenders charge a fee, which is usually a percentage of your loan amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.