Loading

Get Request For Verification Of Mortgage Loan Or Credit Union

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Request For Verification Of Mortgage Loan Or Credit Union online

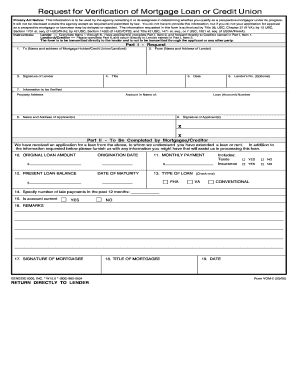

Filling out the Request For Verification Of Mortgage Loan Or Credit Union is an important step in securing financing or verifying your financial status. This guide provides clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete and submit the form

- Click ‘Get Form’ button to obtain the document and open it in your editing tool.

- In Part I, Item 1, enter the name and address of the mortgage holder, credit union, or landlord. This identifies who will receive the verification request.

- In Item 2, provide your own name and address as the lender. Ensure all contact information is accurate.

- In Item 3, the lender or authorized representative needs to sign the document. This signature represents their approval to verify the information.

- In Item 4, include the title of the lender or representative signing the form. This indicates their role within the organization.

- Indicate the date of completion in Item 5; this should reflect the day the form is filled out.

- In Item 6, the lender's number is optional. If available, you may include it for reference.

- In Item 7, fill in the information to be verified including the property address, account name, and loan number related to the mortgage.

- In Item 8, provide the name and address of the applicant(s). This information confirms the individuals applying for the mortgage loan.

- In Item 9, the applicant(s) must sign, acknowledging the request for verification of their mortgage loan.

- Proceed to Part II, which is completed by the mortgagee or creditor. They will provide additional information related to the original loan amount, monthly payment, present loan balance, types of loans, and payment history.

- Once all sections are filled out, review the information for accuracy and completeness.

- Finally, save changes, download, print, or share the completed form as needed. Ensure it is sent directly to the lender indicated in Part I.

Start the process now by completing your Request For Verification Of Mortgage Loan Or Credit Union online.

When a borrower refinances their current loan, the lender sends us a “Verification of mortgage” form. This form asks for information and payment history for the current loan, which includes: Origination date. First interest rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.