Loading

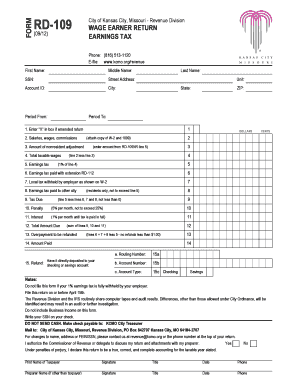

Get Rd-109 Wage Earner Return Bformb Earnings Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RD-109 Wage Earner Return Earnings Tax online

Filing your RD-109 Wage Earner Return Earnings Tax form online is an essential step for individuals earning income in Kansas City. This comprehensive guide will provide you with clear instructions on how to correctly fill out each section of the form to ensure your submission is accurate and compliant.

Follow the steps to effectively complete your RD-109 form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your personal information, including your first name, middle name, last name, social security number, street address, city, state, and ZIP code. Ensure all details are accurate to avoid processing delays.

- In the 'Period From' and 'Period To' fields, enter the tax period for which you are filing.

- If this is an amended return, place an 'X' in the designated box.

- Enter your total salaries, wages, commissions, and other compensations on line 2.

- If you are a nonresident, enter the nonresident adjustment amount on line 3, which you should extract from RD-109NR line 5.

- Calculate your total taxable wages by subtracting line 3 from line 2. Input this total on line 4.

- Compute your earnings tax by multiplying the amount on line 4 by 0.01 (1%). Enter this number on line 5.

- If you paid taxes with an extension, include that amount on line 6.

- Enter any local tax withheld by your employer as shown on your W-2 on line 7.

- For residents only, if you paid earnings tax to another city, note that amount on line 8.

- Calculate the tax due by subtracting the amounts from lines 6, 7, and 8 from line 5. Enter this figure on line 9, but ensure it is not less than zero.

- If line 9 is overdue, add a penalty (5% per month) on line 10 and any interest accrued (1% per month) on line 11.

- Sum lines 9, 10, and 11 for your total amount due, which you will enter on line 12.

- If you have overpaid, enter the refund amount on line 13 and decide if you want the refund via direct deposit by filling out lines 15a, 15b, and 15c.

- Indicate the amount paid on line 14, write your social security number on your check, and ensure not to submit cash.

- Review all sections for accuracy, sign the return, and then save your changes, download, print, or share the completed form as needed.

Complete the RD-109 Wage Earner Return Earnings Tax online and ensure your tax obligations are met efficiently.

Kansas City residents must pay the 1 percent earnings tax no matter where they work. Non-residents pay if they work inside city limits, the idea being that they should share in the cost of the city services they use.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.