Loading

Get Self-employment Ledger 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self-Employment Ledger online

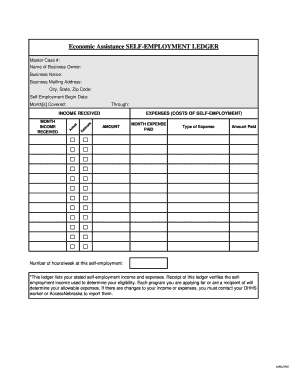

Filling out the Self-Employment Ledger is an essential task for individuals managing their own business finances. This guide provides a step-by-step approach to ensure accurate completion of the form online.

Follow the steps to successfully complete your Self-Employment Ledger.

- Click the ‘Get Form’ button to access the Self-Employment Ledger and open it in your preferred online editor. This allows you to begin filling out the form digitally.

- Enter your personal information in the designated fields. Complete the name of the business owner, business name, mailing address, city, state, zip code, and the self-employment begin date.

- Under the 'Gross Income' section, list all sources of income received during the specified dates. Make sure to fill in the date received, the source of income, and the amounts accurately.

- In the 'Expenses (Costs of Self-Employment)' section, document all allowable business expenses. For each expense, indicate the date paid, the type of expense, and the amount paid. Remember to exclude any non-allowable expenses as listed in the guidelines.

- Indicate the number of hours worked per week in the appropriate field. This information may be relevant for various analyses related to your business.

- Review all entered data for accuracy. Ensure that all income and expenses are correctly reflected on the ledger.

- Once you have verified that all information is accurate and complete, proceed to save your changes. You may download, print, or share the completed form as needed.

Complete your Self-Employment Ledger online today to stay organized and compliant.

To document self-employment income, collect all relevant payment records such as invoices, bank statements, and receipts. Organize these documents chronologically in your self-employment ledger to maintain clarity. Consistent documentation ensures you have all necessary evidence during tax season and facilitates better financial planning. UsLegalForms provides documentation templates that can help you maintain organized records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.