Loading

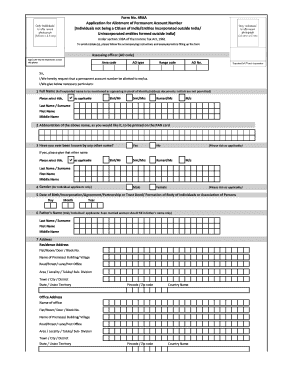

Get In Itd Form No. 49aa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN ITD Form No. 49AA online

This guide provides a comprehensive overview of how to accurately fill out the IN ITD Form No. 49AA online. Designed for individuals and entities seeking a Permanent Account Number, this information will help ensure a smooth application process.

Follow the steps to complete the IN ITD Form No. 49AA.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Provide your full name as indicated in your proof of identity. Ensure that initials are not included. Select the appropriate title from the options provided.

- Enter your last name, first name, and middle name accordingly.

- Specify the abbreviated name you would like printed on the PAN card. This abbreviation should not include any titles.

- Indicate if you have ever been known by any other name. If yes, provide that name, ensuring it follows the same formatting as your full name.

- Select the appropriate title, and fill out your last name, first name, and middle name.

- For individual applicants only, indicate your gender by ticking the appropriate box.

- Your gender should be recorded to ensure accurate identification.

- Fill in your date of birth or incorporation according to the applicable format (Day, Month, Year). This should reflect your actual date of birth.

- If you are an individual applicant, provide your father's name. Ensure to follow the formatting from step 2.

- This should include last name, first name, and middle name.

- Enter your residence address accurately. Include Flat/Room details, premises name, road/street name, area/locality, town/city, state, and postal code.

- You may also provide your office address if applicable.

- Specify the address for communication by indicating whether it is your residence or office.

- This choice is important for future correspondence.

- Provide your telephone number and email ID. Include the country code and area code as applicable.

- Select your status as an applicant from the provided options, such as individual, partnership firm, company, etc.

- If applicable, enter your registration number as per the category of the applicant selected in step 11.

- This is necessary for companies and firms only.

- Indicate your country of citizenship.

- This section is crucial for confirming your nationality.

- Select your source of income from the options provided. If claiming income from business or profession, include a business code.

- You may need to refer to the instructions for specific codes.

- If you have a representative or agent in India, provide their full name and address, ensuring to also follow the naming conventions established earlier.

- List the documents you are submitting as proof of identity and proof of address, confirming that they are certified and comply with specified guidelines.

- Complete the KYC details if applicable, ensuring to comply with the regulations set by the Securities and Exchange Board of India.

- Note that this applies specifically to foreign institutional investors.

- Review the entire form for accuracy and completeness. Once verified, save your changes, and proceed to download, print, or share the form as needed.

Complete your IN ITD Form No. 49AA online to ensure a seamless application process.

Yes, US citizens can indeed have PAN cards in India by applying through IN ITD Form No. 49AA. This process enables them to engage in various financial activities within India, enhancing their ability to manage investments and taxation. Make sure to consult reliable resources for guidance during your application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.