Loading

Get Seterus F054f 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Seterus F054F online

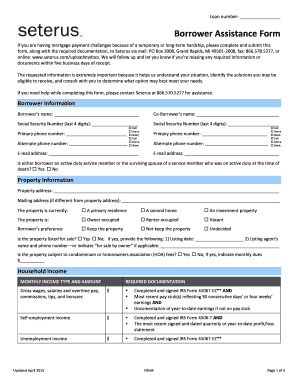

Filling out the Seterus F054F form is an important step for individuals facing mortgage payment challenges. This guide provides clear instructions on each section of the form to ensure you can complete it efficiently and effectively.

Follow the steps to complete the online form seamlessly.

- Press the ‘Get Form’ button to access the form and open it in the designated editor.

- Begin by providing your loan number at the top of the form where indicated.

- In the Borrower Information section, fill in the names of the borrower and co-borrower, along with their respective Social Security numbers (last 4 digits), primary phone numbers, and email addresses.

- Indicate whether either borrower is an active duty service member or a surviving spouse by checking the appropriate box.

- In the Property Information section, enter the property address and, if applicable, the mailing address. Specify the current status of the property as a primary residence, second home, or investment property.

- Provide information regarding the occupancy of the property, the borrower's preferences about keeping the property, and whether the property is listed for sale.

- Proceed to the Household Income section. For each income type (such as gross wages, self-employment income, and others), enter the monthly income amount and ensure you note the required documentation.

- Fill in the Household Assets section, detailing accounts and total assets as requested.

- In the Hardship Information section, specify the beginning of the hardship and select the applicable types of hardship affecting mortgage payments.

- In the Borrower Certification section, read through the statements carefully and provide your signature along with the date. If applicable, the co-borrower should also provide their signature and date.

- Once all fields are completed, review the form for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Complete your Seterus F054F form online today to take the next step towards addressing your mortgage payment challenges.

To email Mr. Cooper, visit their official website for the contact form or email address. You may need to provide specific account details to receive targeted assistance related to Seterus F054F. Their support team aims to respond promptly to your email inquiries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.