Loading

Get Request For Withdrawal From A Deferred Account - 401ksave

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the REQUEST FOR WITHDRAWAL FROM A DEFERRED ACCOUNT - 401ksave online

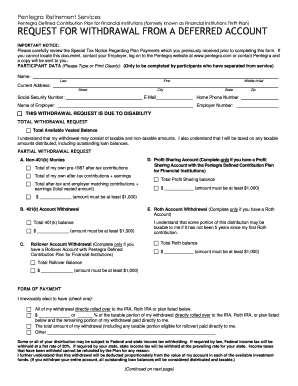

The REQUEST FOR WITHDRAWAL FROM A DEFERRED ACCOUNT - 401ksave is designed for participants seeking to withdraw their funds from a deferred account. This guide will provide comprehensive, step-by-step instructions on how to accurately complete the form online, ensuring that all required information is filled out correctly.

Follow the steps to successfully complete your withdrawal request.

- Press the ‘Get Form’ button to access the withdrawal request form. This will allow you to download and open the form in your preferred document editor.

- Begin by filling out the participant data section. Clearly type or print the following information: your name (last, first, middle initial), current address (street, city, state, zip), social security number, email address, home phone number, and employer name. Ensure accuracy as this data is crucial for processing your request.

- Indicate the type of withdrawal you are requesting. Choose either the total withdrawal option if you wish to withdraw your entire available vested balance or the partial withdrawal option and specify the amounts for non-401(k) monies, 401(k) account, Roth account, or rollover account withdrawals as applicable.

- For the form of payment section, select your payment preference. You can choose to roll over all or part of your withdrawal, have the withdrawal paid directly to you, or specify a combination of both. Ensure you complete the required fields for your chosen option, including providing details about the receiving plan if rolling over.

- Review the instructions for direct rollover. Properly fill in the name and address of the receiving plan or institution if applicable, and ensure you attach any necessary certifications to support your request.

- Complete the certification statement acknowledging that you have reviewed the 'Special Tax Notice Regarding Plan Payments' and understand the implications of your withdrawal. Sign and date the form to authenticate your request.

- Finally, verify all the information entered for accuracy. Once confirmed, you may save your changes, download, print, or share the completed form as necessary to ensure your request is submitted properly.

Initiate your request for withdrawal online to ensure a smooth and efficient process.

By age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401(k) without having to pay a penalty tax. You'll simply need to contact your plan administrator or log into your account online and request a withdrawal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.