Loading

Get Form Dt1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Dt1 online

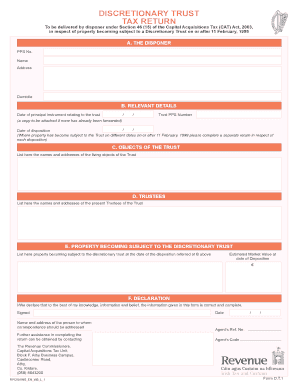

Filling out the Form Dt1 online is an essential task for individuals involved in managing a discretionary trust. This guide offers a clear and supportive approach to assist users in completing the form accurately and efficiently.

Follow the steps to fill out the Form Dt1 online.

- Click the ‘Get Form’ button to obtain the form and open it in an appropriate editing platform.

- Enter the details of the disponer in Section A, including their PPS number, full name, address, and domicile.

- In Section B, provide relevant trust details. Enter the date of the principal instrument related to the trust and the trust PPS number. Attach a copy if it has not been previously submitted.

- Also in Section B, specify the date of disposition. If the property became subject to the trust on multiple dates, complete a separate return for each disposition.

- In Section C, list the names and addresses of the living objects of the trust.

- For Section D, include the names and addresses of the current trustees of the trust.

- In Section E, detail the property becoming subject to the discretionary trust as of the specified date, and provide the estimated market value at that date.

- Finally, Section F requires a declaration. Indicate that the information provided is accurate to the best of your knowledge, sign the form, and provide the name and address of the person for correspondence. Include the date.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your documents online with confidence.

Minnesota counties collect Deed Tax when an instrument conveying Minnesota real property is presented for recording.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.