Get Ca Pers-bds-369-s 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA PERS-BDS-369-S online

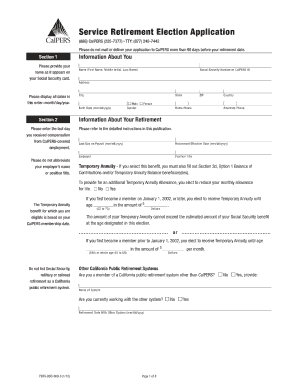

The CA PERS-BDS-369-S is an essential form for individuals filing for service retirement with CalPERS. This guide provides a clear and detailed approach for completing the form online, ensuring that users can navigate through the required sections efficiently.

Follow the steps to fill out the CA PERS-BDS-369-S online.

- Click the ‘Get Form’ button to obtain the CA PERS-BDS-369-S, which you will open in your preferred online editor.

- Fill out Section 1 with your name as it appears on your Social Security card, along with your address, city, birth date, and other required personal information.

- In Section 2, enter your Social Security Number or CalPERS ID, contact information, gender, employer, position title, last day on payroll, and retirement effective date.

- Complete Section 3 by selecting your retirement payment option and designating beneficiaries. Make sure to follow the guidance provided in the form carefully.

- If applicable, fill out Section 3a for Individual Lifetime Beneficiary information or Section 3b for Multiple Lifetime Beneficiaries.

- In Section 4, designate the recipient of your Lump-Sum Retired Death Benefit; include their information as instructed.

- Complete Section 5 regarding survivor continuance, indicating marital status, children, and other dependents.

- In Section 6, choose your federal and state tax withholding options based on your preferences.

- Fill out Section 7 regarding CalPERS health coverage, deciding if you wish to continue coverage into retirement.

- Finally, in Section 8, sign the form and ensure that any required signatures from your spouse or domestic partner are notarized.

- Save your changes, download the completed form, and print it if necessary, or share it as required.

Complete your documents online to ensure timely processing of your retirement application.

The CalPERS 1000 hour rule states that an employee must not exceed 1,000 hours of service in a fiscal year if they wish to retain their retirement benefits. This is crucial for maintaining eligibility for pension plans while ensuring compliance with the system's regulations. It's important to stay informed about your hours to avoid any impacts on your benefits. For a clearer understanding of this rule, check out resources like CA PERS-BDS-369-S.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.