Loading

Get Sc4852

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sc4852 online

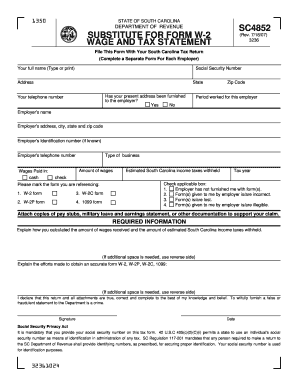

The Sc4852 form, also known as the Substitute for Form W-2 Wage and Tax Statement, is essential for filing your South Carolina tax return when you have not received your W-2 from an employer. This guide offers comprehensive instructions on how to accurately complete the Sc4852 form online.

Follow the steps to effectively complete the Sc4852 form.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor. Ensure you have a stable internet connection for a seamless experience.

- Begin by entering your full name in the designated field. Ensure it matches your identification documents for accuracy.

- Input your Social Security Number (SSN) in the next field. This number is mandatory for identification and filing purposes.

- Provide your current address, including the city, state, and zip code. Double-check to ensure all details are accurate.

- Indicate whether your present address has been shared with your employer by selecting either 'Yes' or 'No.'

- Fill in your telephone number for any necessary follow-up regarding your form.

- Specify the period you worked for the employer in question. This information can typically be found on your employment records.

- Enter the employer's name along with their address, including city, state, and zip code. If applicable, provide their Employer Identification Number (EIN) and telephone number.

- Detail the amount of wages paid to you, specifying if it was in cash or by check.

- State the estimated South Carolina income taxes that were withheld from your wages.

- Indicate the tax year for which you are filling out the Sc4852 form.

- Mark the form type you are referencing, either W-2, W-2C, W-2P, or 1099, by selecting the corresponding checkbox.

- Choose the appropriate reason for submitting the Sc4852 from the provided options related to the absence or inaccuracy of your original W-2 form.

- Attach copies of relevant documentation, such as pay stubs or military leave statements, to support your claims.

- In the required information section, explain how you calculated the wages received and the estimated tax withheld. You may utilize the back of the form if more space is needed.

- Detail the efforts you made to acquire an accurate W-2 or related forms from your employer. Again, use the reverse side if more space is required.

- Finally, sign and date the form to declare that the information provided is accurate to the best of your knowledge.

- Once completed, you can save the changes, download a copy for your records, print the form, or share it as needed.

Complete your Sc4852 and file your documents online for a streamlined process.

If you are filing your tax return using an online provider, mail Form 8453 to the IRS within 3 business days after you have received acknowledgement from your intermediate service provider and/or transmitter that the IRS has accepted your electronically filed tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.