Loading

Get Fha Identity Of Ineterst Disclosure

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FHA Identity of Interest Disclosure online

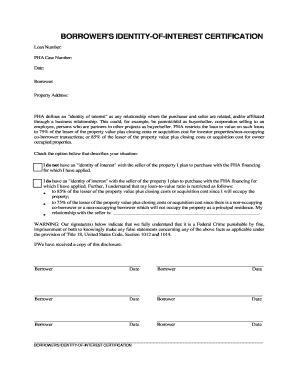

Filling out the FHA Identity of Interest Disclosure is an important step in the home buying process, especially when the buyer has a relationship with the seller. This guide will walk you through the process of completing the form online, ensuring you provide all necessary information accurately.

Follow the steps to complete the FHA Identity of Interest Disclosure.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your loan number in the designated field. This number is unique to your loan application and is crucial for processing.

- Input your FHA case number. This number is assigned by the Federal Housing Administration and is required for all FHA loans.

- Fill in today’s date in the appropriate space. This date is necessary to validate the document.

- Complete the borrower's section by entering your name. Ensure that it matches the name used in other loan documents.

- Provide the property address where you plan to purchase. This should include the street address, city, state, and zip code.

- Select the option that describes your relationship with the seller: either indicate 'I do not have an identity of interest' or 'I do have an identity of interest' and provide details about your relationship with the seller.

- Acknowledge your understanding of the loan-to-value restrictions by reading the descriptions provided after the ‘identity of interest’ options.

- Review the warning statement regarding false statements, ensuring you understand the legal implications.

- Sign and date the document in the designated areas. If there are multiple borrowers, ensure each one signs and dates accordingly.

- Once all fields are completed and reviewed, save your changes, and choose to either download, print, or share the completed form as needed.

Complete your FHA Identity of Interest Disclosure online today to ensure a smooth home buying process.

*Maximum LTV for Identity of Interest transactions is 85%. **If the borrower's minimum decision credit score is > 580 then the borrower eligible for max financing. If the borrower's minimum decision credit score is between 500 and 579 then the borrower is limited to a maximum 90% LTV.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.