Loading

Get Instructions For Toledo Form W3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INSTRUCTIONS FOR TOLEDO FORM W3 online

This guide provides a clear and supportive method for completing the INSTRUCTIONS FOR TOLEDO FORM W3 online. By following these steps, users can efficiently submit their reconciliation of income tax withheld from wages.

Follow the steps to successfully complete the form.

- Press the 'Get Form' button to access the Toledo Form W3 and open it in your preferred online editor.

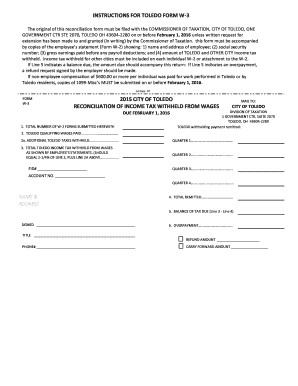

- Begin by entering the total number of W-2 forms submitted with this return in the designated field at the top of the form.

- Fill in the amount of Toledo qualifying wages paid in the relevant section. Make sure the figures are accurate and reflect total wages for your employees.

- Record any additional Toledo taxes withheld in the corresponding field. It is essential to separate these from other deductions.

- Calculate the total Toledo income tax withheld from wages, which should equal 2-1/4% of line 2 plus the amount from line 2a. Ensure that your calculations are precise.

- Complete all quarterly fields accordingly, entering the amounts due for each quarter of the year.

- If there is a balance due indicated on line 5, include the payment amount with your submission. If your calculations show an overpayment, fill out the refund request and specify the amount.

- Sign and date the form, and include your title and contact number. This information is essential for processing your submission.

- Once all sections are complete, you can save your changes, download or print the form, and share it with the relevant authorities as needed.

Begin filling out your Toledo Form W3 online today to ensure your compliance with local tax regulations.

Individuals who wish to pay by online can now make these payments through Authority TaxConnect. Authority TaxConnect is available to individual taxpayers and will allow them to create a secure login, review their tax balances for each year and make payments. A 2.5% fee applies to payments made with credit card.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.