Loading

Get Dannville Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dannville Form online

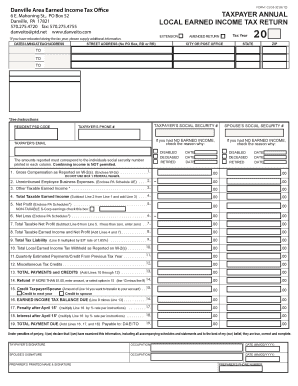

Filling out the Dannville Form online can streamline your tax return process and ensure that all necessary information is accurately provided. This guide offers a step-by-step approach to assist users in completing their form efficiently.

Follow the steps to successfully complete your Dannville Form.

- Press the 'Get Form' button to access the Dannville Form online in the designated editor.

- Begin by entering your street address without using a P.O. Box, rural delivery (RD), or rural route (RR) number. Make sure to include the full address along with your city, state, and ZIP code.

- Fill in the taxpayer's social security number, phone number, and email address as required. If you had no earned income, check the applicable reason from the provided options (disabled, deceased, retired).

- Report your gross compensation based on your W-2 forms in the corresponding section. Please ensure that you do not use Box 1 of federal wages and enclose copies of your W-2s.

- Complete the section for unreimbursed employee business expenses, and include the PA Schedule UE as necessary.

- If applicable, report any other taxable earned income in the designated field.

- Calculate your total taxable earned income by subtracting the unreimbursed employee business expenses from your gross compensation and adding any other taxable earned income.

- Proceed to report net profit or net loss, enclosing the appropriate Pennsylvania schedules as required.

- Calculate your total taxable earned income and net profit by summing the specified lines.

- Determine your total tax liability by multiplying the total taxable earned income by the earned income tax rate of 1.65%.

- Document any local earned income tax withheld as reported on your W-2s and any quarterly estimated payments or credits from the previous tax year.

- Compile any miscellaneous tax credits that may apply.

- Add your total payments and credits together to find the overall amount.

- If applicable, calculate any potential refund or select the option to transfer credits to your account.

- Determine the earned income tax balance due by subtracting total payments from total tax liability.

- If applicable, include any penalties and interest that may have accrued after the filing deadline.

- Finish by indicating any non-taxable S-Corp earnings and specifying your payment instructions.

- Lastly, ensure that both the taxpayer and spouse sign and date the form, and include the preparer's printed name and contact information if applicable.

- Once all sections are completed, save your changes and choose options to download, print, or share the form as needed.

Complete your Dannville Form online today for a seamless filing experience.

Related links form

The proposed salary for the Mayor is $12,000 per year and $10,000 per year for Council Members. Citizens will have the opportunity to be heard and express their opinions on this matter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.