Loading

Get Form St16 Application For Nonprofit Exempt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST16 Application For Nonprofit Exempt online

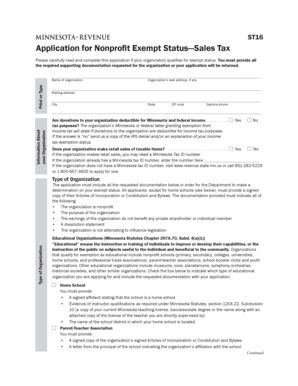

Completing the Form ST16 Application For Nonprofit Exempt is a crucial step for organizations seeking tax exemptions. This guide will provide you with clear, step-by-step instructions to ensure you fill out the form accurately and efficiently.

Follow the steps to complete the application form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name of your organization in the designated field. Ensure that the name is spelled correctly and matches the organization's legal documents.

- Provide your organization’s web address, if available. If there is none, this field can be left blank.

- Enter the mailing address for your organization, including city, state, and zip code.

- Indicate whether donations to your organization are deductible for Minnesota and federal income tax purposes by selecting 'Yes' or 'No'. If 'No', include documentation such as a copy of the IRS denial.

- Specify if your organization makes retail sales of taxable items by selecting 'Yes' or 'No'. If 'Yes', make sure to provide your Minnesota Tax ID number. If you do not have one, follow the instructions provided to apply for it.

- Specify the type of organization you are applying for. Depending on the category selected, attach the necessary documentation indicated in the application, such as Articles of Incorporation or Constitution and Bylaws.

- Once all fields are completed and the required documentation is attached, review the form for accuracy and completeness.

- Save any changes you made on the form. You can also download, print, or share the completed form as needed.

Complete your Form ST16 Application For Nonprofit Exempt online to ensure your organization receives the proper tax exemptions.

To apply for nonprofit exempt status, you must complete Form ST16, Application for Nonprofit Exempt Status – Sales Tax. We will send you a letter notifying you if you qualify or not. If your organization does not meet the criteria listed above, your organization does not qualify for nonprofit exempt status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.