Loading

Get Integrated Disclosure Addendum Mortgage

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INTEGRATED DISCLOSURE ADDENDUM MORTGAGE online

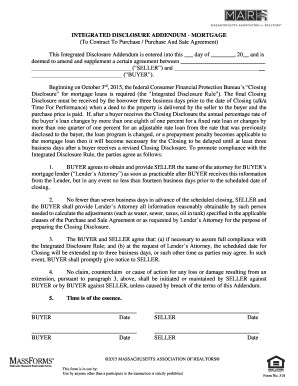

The Integrated Disclosure Addendum Mortgage is an essential document used in real estate transactions, providing clarity on the obligations and timing for buyers and sellers. This guide will help you navigate the online process of filling out this important form.

Follow the steps to complete your document accurately.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by entering the date on which you are filling out the addendum in the specified field – this is typically the ___ day of ________, 20__.

- Complete the seller and buyer information sections by providing the full names and details of both the seller and buyer, ensuring accuracy.

- In the section regarding the attorney for the buyer's mortgage lender, indicate the name of the Lender’s Attorney once that information is available, ensuring it is done within fourteen business days prior to closing.

- Gather and provide information regarding adjustments such as water, sewer, taxes, and any other necessary details to the Lender’s Attorney no fewer than seven business days before the scheduled closing.

- Acknowledge that you may need to extend the closing date if necessary—over three business days or as mutually agreed upon—especially if revisions to the Closing Disclosure are required.

- Finally, review the entire document for accuracy. Once you have verified all fields are correctly filled, you can save your changes, download, print, or share the completed form as needed.

Complete your documents online today for an easier transaction experience.

Your lender is required by law to give you the standardized Closing Disclosure at least 3 business days before closing. This is what is known as the Closing Disclosure 3-day rule. This requirement is thanks to the TILA-RESPA Integrated Disclosures guidelines, which went into effect on October 3, 2015.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.