Loading

Get Application Form For Mses - Indian Banks Association

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APPLICATION FORM FOR MSEs - Indian Banks Association online

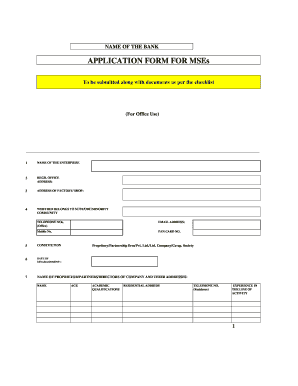

Filling out the application form for MSEs from the Indian Banks Association is an important step in securing financial support for your micro or small enterprise. This guide provides clear, step-by-step instructions to help you successfully complete the form online.

Follow the steps to accurately fill out the application form

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the 'Name of the Enterprise' as specified in your business registration documents.

- Provide the 'Registered Office Address' and ensure it matches your official business address.

- Fill in the 'Address of Factory/Shop' where your operations take place.

- Indicate whether your enterprise belongs to SC/ST/OBC/Minority community and enter your official 'Telephone No', 'Email Address', and 'Mobile No'.

- Provide your 'PAN Card No.' for tax identification purposes.

- Select your 'Constitution' — such as Proprietorship, Partnership, Private Ltd., etc., and enter the 'Date of Establishment' of your enterprise.

- List the 'Name of Proprietor/Partners/Directors' along with their respective addresses, ages, academic qualifications, and experience in the field.

- Describe the 'Activity' of your enterprise, indicating both existing and any proposed activities.

- List any 'Names of Associate Concerns' and detail the nature of association with these concerns.

- Disclose your 'Credit Facilities (Existing)', including type, limit, outstanding, and banking details.

- Confirm certification that your unit has not availed loans from other banks/financial institutions.

- Outline 'Credit Facilities (Proposed)', specifying type, amount, purpose, and security offered.

- Provide information regarding 'Details of Collateral Security offered' if applicable.

- Complete the 'Past Performance/Future Estimates' with financial data from previous years and projections.

- Indicate the status regarding 'Statutory Obligations' by marking compliance for each requirement.

- Attach the necessary photos of the proprietor/partners/directors and ensure they are certified by the Branch Team.

- Review all entered information for accuracy and save your changes.

- Once complete, download, print or share the form as needed.

Begin filling out your application form online today to ensure your MSE receives the necessary support.

MSME Loan Interest Rates of Top Banks Bank NameInterest RateIndian Bank8.75% p.a. onwardsCentral Bank of IndiaAt the discretion of the bankPunjab and Sind Bank9.05% p.a. onwardsPunjab National Bank9.60% p.a. onwards4 more rows • Jan 24, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.