Loading

Get Form 2400a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2400a online

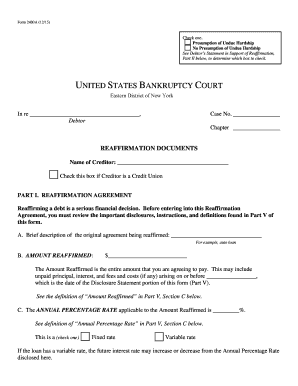

Filling out Form 2400a is an essential step in the reaffirmation process for individuals undergoing bankruptcy. This guide provides a clear and supportive pathway to help users complete the form accurately and efficiently online.

Follow the steps to successfully complete Form 2400a online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by checking the appropriate box for 'Presumption of Undue Hardship' or 'No Presumption of Undue Hardship' based on the guidance provided in Part II below.

- In the section labeled 'Name of Creditor', fill in the name of the creditor involved in the reaffirmation. Check the box if the creditor is a credit union.

- For Part I, start with a brief description of the original agreement being reaffirmed, such as 'auto loan'. Next, provide the total 'Amount Reaffirmed' which includes unpaid principal, interest, and other fees up to the date specified.

- Indicate the Annual Percentage Rate applicable to the Amount Reaffirmed, selecting whether it is a 'Fixed rate' or 'Variable rate'.

- Complete the repayment terms for the reaffirmed debt, specifying the monthly payment amount and duration or any changes in repayment terms.

- Describe any collateral securing the debt and provide its current market value.

- Answer whether the debt arose from the purchase of the collateral, providing the purchase price or original loan amount as necessary.

- Specify the changes made by the Reaffirmation Agreement to the most recent credit terms, including the balance, percentage rate, and monthly payment.

- Complete the Debtor’s Statement in Support of Reaffirmation Agreement, indicating if you were represented by an attorney and if the creditor is a credit union.

- Certify your agreement by signing the document in Part III, ensuring that both debtors sign if it is a joint reaffirmation agreement.

- If applicable, have your attorney sign Part IV if they represented you during the negotiation.

- Finally, save your changes and download, print, or share the completed Form 2400a as required to ensure it is filed correctly with the bankruptcy court.

Get started on filling out your Form 2400a online today!

Normally, as long as a debtor is making timely monthly mortgage payments and is not in default, the bank will not foreclose on the home, even absent the signing of a reaffirmation agreement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.