Loading

Get Public Information Notice Pursuant To Hawaii Revised

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PUBLIC INFORMATION NOTICE PURSUANT TO HAWAII REVISED online

This guide offers clear and supportive instructions for filling out the Public Information Notice pursuant to Hawaii Revised Statutes online. By following these steps, you will understand each component of the form and be able to complete it accurately and efficiently.

Follow the steps to complete the form successfully.

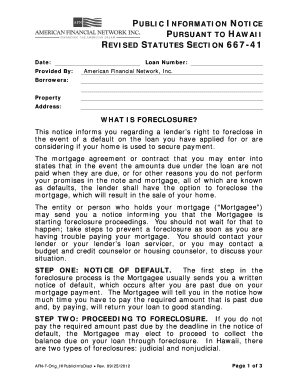

- Click the ‘Get Form’ button to access the Public Information Notice. This will open the form in an editable format so you can begin filling it out.

- Enter the required date at the top of the form, which signifies when you are submitting the notice. This date is essential for tracking purposes.

- Fill in the name of the entity providing the notice, along with the loan number associated with the mortgage. This information helps to clarify which loan the notice pertains to.

- List the names of all borrowers associated with the loan. Make sure to enter each name accurately to avoid any confusion during the foreclosure process.

- Provide the property address where the home is located. This is crucial information for identifying the property involved in the potential foreclosure.

- Review the section explaining what foreclosure is and ensure you understand the implications for your situation. Familiarizing yourself with this content can aid in decision-making.

- Complete the signature section by having all borrowers sign and date the document. This confirms that everyone named is aware of and agrees to the information in the notice.

- Lastly, review all entries for accuracy, make any necessary corrections, and then save your changes. You can also choose to download, print, or share the completed form as needed.

Complete your documents online today and stay informed about your rights and responsibilities.

Foreclosure Sales in Hawaii The lender usually makes a bid on the property using a "credit bid" rather than bidding cash. With a credit bid, the lender gets a credit up to the amount of the borrower's debt. The highest bidder at the sale becomes the new owner of the property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.