Loading

Get In Form 46021 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form 46021 online

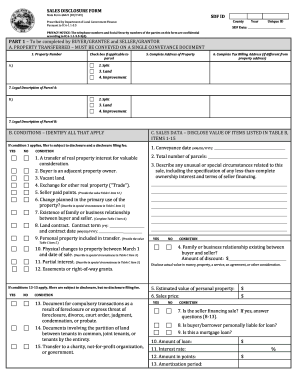

The IN Form 46021 is crucial for the sales disclosure process in Indiana. This guide will provide you with an easy-to-follow approach to complete the form online, ensuring you understand each section and its requirements.

Follow the steps to accurately complete the sales disclosure form online.

- Press the ‘Get Form’ button to download and access the sales disclosure form in your preferred format.

- Begin filling out Part 1 of the form, which includes details about the property being transferred. Enter the property number and check the applicable boxes for any pertinent property conditions.

- Provide the complete address of the property, including the tax billing address if it differs from the property's address.

- Fill out the legal description of the property. Ensure this is accurate, as it is essential for property identification.

- Complete any necessary conditions that apply to the sale in Part 1. Indicate all applicable conditions that could affect the transaction.

- In the sales data section, disclose the conveyance date and the total number of parcels involved. Specify any unusual circumstances regarding the sale.

- Proceed to fill out the preparer’s information. Include the preparer's full name, title, company, contact details, and a valid email address.

- Next, fill in the seller(s)/grantor(s) section with the names and addresses as they appear on the conveyance document.

- In the buyer(s)/grantee(s) section, include all necessary information about the buyer(s), such as names, addresses, and intended use of the property.

- After completing all sections, review the form for accuracy and completeness. Save your changes.

- Finally, download a copy of the completed form, print it if necessary, or share it with relevant parties as needed before submitting.

Complete your documents online and ensure a smooth sales disclosure process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file form 472, you must gather the relevant financial information and complete the form with precision. Ensure that all data aligns with your tax filings, and then submit it to the appropriate tax authority by the deadline. If you are unsure about any step in this process, you can rely on the uslegalforms platform for comprehensive resources that can simplify filing requirements and procedures.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.