Loading

Get Il Form B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL Form B online

This guide provides a clear and supportive approach to filling out the IL Form B. By following these steps, users can easily navigate the process of completing the form online.

Follow the steps to successfully complete the IL Form B

- Press the ‘Get Form’ button to retrieve the document and open it for editing.

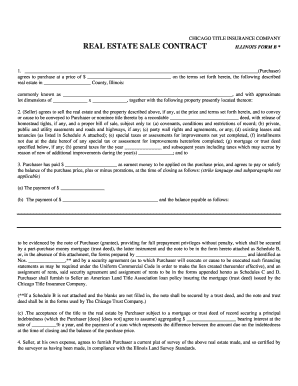

- In the first section, enter the name of the purchaser and the agreed purchase price for the real estate. Be specific about the property description and location, including county details and lot dimensions.

- Document the earnest money amount that the purchaser has paid, and outline the balance payment schedule at closing. Include all necessary details for any financing arrangements.

- Complete the seller's warranty regarding any known violations related to the property and ensure all seller and purchaser signatures, including addresses, are filled in.

- Once all sections are completed, save your changes. You can choose to download, print, or share the form as needed.

Encourage users to complete their IL Form B online for a seamless and efficient experience.

Related links form

Filling out the Illinois state withholding form requires you to input personal details and claim the appropriate number of allowances based on your situation. Be sure to review your previous year’s tax filings or consult with a tax professional for guidance. Completing this form accurately helps in maintaining the correct withholding levels. The IL Form B is an excellent tool to assist in this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.