Loading

Get Life Insurance Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Life Insurance Application Form online

Completing the Life Insurance Application Form online can be a straightforward process. This guide will provide you with clear, step-by-step instructions to help you navigate each section of the form, ensuring that you provide all necessary information accurately.

Follow the steps to successfully complete your online application.

- Press the ‘Get Form’ button to access the application form and open it in the designated editor.

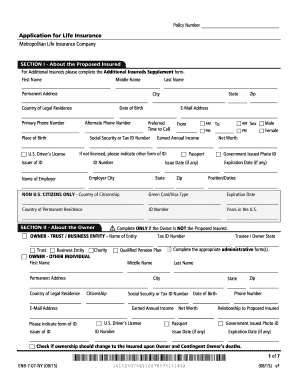

- Begin with Section I: About the Proposed Insured. Fill in the proposed insured’s first name, middle name, last name, permanent address, date of birth, and contact information. Be sure to provide accurate identification details.

- Move to Section II: About the Owner, if applicable. If the owner is not the proposed insured, complete the owner's information, including their identity verification details and relationship to the proposed insured.

- In Section III: About the Beneficiary/Beneficiaries, list the beneficiaries' names and their relationships to the proposed insured. Specify the percentage of proceeds each will receive.

- Proceed to Section IV: About Proposed Coverage. Select the type of coverage you desire (e.g., whole life, term life) and input specific details such as coverage amounts and any riders you wish to add.

- Section V: About Existing or Applied-for Insurance. Indicate whether there are existing policies or if any other life insurance applications are in progress. If applicable, provide detailed information as requested.

- In Section VI: About Payment Information, specify payment details, including the method of payment, billing frequency, and the premium payer's information if different from the insured.

- Complete Section VII: General Risk Questions. Answer all questions honestly regarding the proposed insured’s health and lifestyle.

- In Section VIII: Personal Physician, provide the name and contact details of the insured's physician or indicate if there is none.

- Review Section IX: Additional Information for any necessary details that may not fit elsewhere. Attach additional sheets if required.

- Finally, ensure all required signatures are obtained as indicated in the agreement and disclosure sections. Once complete, users can save changes, download, print, or share the form.

Don't wait; start completing your Life Insurance Application Form online now!

What are the start-up costs? Depending on which state you choose to operate, the start-up costs will vary. Generally, you can expect to pay anywhere from $5,000 to $50,000 to start your insurance business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.