Loading

Get Form Ct1 - Application By Trustees For Incorporation As A - Societies Govt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT1 - Application By Trustees For Incorporation As A - Societies Govt online

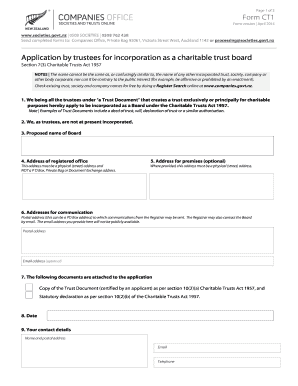

Filling out Form CT1 is an essential step for trustees seeking incorporation as a charitable trust board under the Charitable Trusts Act 1957. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete your application successfully.

- Press the ‘Get Form’ button to obtain the form and access it in the editor. Ensure you are using an up-to-date version of the form.

- In the first section, confirm that all the trustees listed are operating under a Trust Document specifically created for charitable purposes. If not, you must ensure compliance before proceeding.

- Enter the proposed name of the Board. Ensure that the name is unique and not closely resembling any existing incorporated trusts, societies, or companies.

- Provide the address of the registered office. This must be a physical street address; P.O. Boxes or private bags are not acceptable.

- If applicable, fill out the address for premises. This is also a physical street address and can be separate from the registered office.

- Complete the addresses for communication section. Here you can include a postal address (P.O. Box is acceptable) for any communications from the Registrar, and optionally an email address for direct contact.

- State clearly the documents you are attaching to the application. This includes a certified copy of the Trust Document and a statutory declaration as specified in the Charitable Trusts Act 1957.

- Fill in the date of completion of the form. Ensure it reflects the current date of submission.

- Provide your contact details, including name, postal address, email, and telephone number. This information is vital for any follow-up communication.

- Gather the signatures of all trustees submitting the application. Each trustee must provide their full name, signature, and residential address.

- Complete the statutory declaration section honestly, confirming that no other trusts are held by the applicants outside of those specified in the Trust Document. Have the declaration signed and witnessed by a qualified person.

- Once all sections are complete, review the form for accuracy. After confirming the information is correct, finalize your application by saving, downloading, printing, or sharing the form as needed.

Complete your Form CT1 application online today and take the next step towards incorporating your charitable trust.

WHO MUST FILE FORM CT-TR-1? Charitable organizations whose total revenue for the fiscal year is under $50,000 must file Form CT-TR-1 and RRF-1 with the Attorney General's Office. Private foundations are not required to file Form CT-TR-1 and instead must file IRS Form 990-PF with the RRF-1.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.