Loading

Get 457b Deferred Compensation Plan Withdrawal Request - Glpagent

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 457b DEFERRED COMPENSATION PLAN WITHDRAWAL REQUEST - GLPAgent online

This guide provides a comprehensive overview of how to fill out the 457b deferred compensation plan withdrawal request form online. It is designed to assist users in navigating the form’s components efficiently and accurately.

Follow the steps to complete your withdrawal request form online.

- Press the ‘Get Form’ button to obtain the withdrawal request form and open it in your preferred document editor.

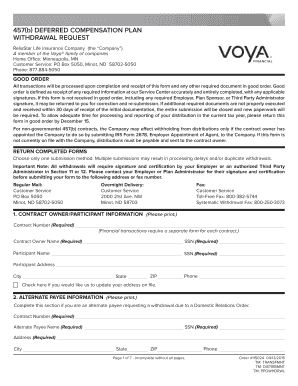

- In section 1, provide your contract owner/participant information. This includes entering your contract number, full name, Social Security number (SSN), participant address, and phone number. Make sure to check the box if you want to update your address on file.

- Complete section 2 if you are an alternate payee requesting withdrawal due to a Domestic Relations Order. Enter your contract number, name, SSN, address, and phone.

- In section 3, if applicable, specify the financial institution you are transferring assets to. Include the financial institution's name, and your advisor or agent's name.

- Section 4 requires you to select the type of withdrawal. Choose from partial, full, or systematic withdrawal and provide the necessary details such as the amount.

- Section 5 allows you to specify from which investment option to withdraw funds. Provide the fund names, numbers, and amounts or percentages.

- In section 6, select the reason for withdrawal and provide any necessary dates, particularly if it relates to employment severance or disability.

- Section 7 asks you to select the withdrawal type. Read and choose the appropriate distribution type for governmental or non-governmental plans.

- In section 8, complete the tax withholding options. Specify whether you want federal and state taxes withheld and provide the required details.

- Fill out section 9 if you choose electronic fund transfer, providing all bank details like account type, account holder name, and ABA routing number.

- In section 10, provide your authorized signature and tax withholding certification. Ensure all information is accurate and complete.

- Complete sections 11 and 12 for employer/plan sponsor and third-party administrator signatures if required.

- Finally, review the form for accuracy, save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your withdrawal request form online today!

457(b) Assets can be withdrawn without penalty at any age upon separation from service from the plan sponsor, or age 70½ if still working.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.