Loading

Get Modelo 990

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Modelo 990 online

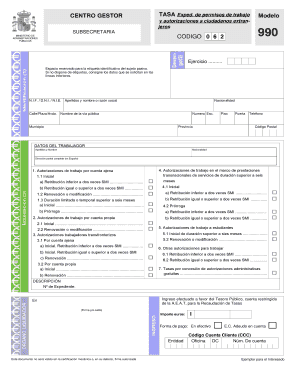

Filling out Modelo 990 is an essential process for requesting work permits and authorizations for foreign citizens in Spain. This guide provides step-by-step assistance to ensure you navigate the online form accurately and efficiently.

Follow the steps to complete the Modelo 990 online.

- Click the ‘Get Form’ button to retrieve the Modelo 990. This will open the form in your online editor.

- Begin filling out the identification section. Enter your nationality, N.I.F., D.N.I., or N.I.E., followed by your full name or business name.

- Provide your address details including street name, building number, municipality, province, and postal code.

- In the 'Datos del trabajador' section, input the worker's full name and nationality, as well as their complete postal address.

- Look at the various authorization types for work: starting with 'Autorizaciones de trabajo por cuenta ajena,' choose whether it's an initial authorization, a renewal, or a temporary authorization. Supporting details regarding the salary arrangements should also be completed as necessary.

- Continue with other sections as applicable, including authorizations for self-employment, cross-border workers, and student work permits.

- Input the total amount regarding payment of fees and select your method of payment. Fill in any required banking information.

- Review all entered data to ensure accuracy. Once confirmed, you can save your changes, download the form, print it, or share it as needed.

Complete your documents online today to ensure a smooth application process.

Safe and Secure Filing Tax990 is SOC-2, HackerProof certified and supports 2FA for enhanced data security.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.