Loading

Get City Of Big Rapids Application For Extension - Cityofbr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CITY OF BIG RAPIDS APPLICATION FOR EXTENSION - Cityofbr online

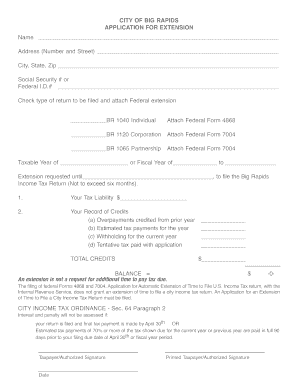

This guide provides clear, step-by-step instructions for completing the City of Big Rapids Application for Extension online. Whether you are seeking additional time to file your city income tax return or need clarification on specific sections of the form, this guide will support you through the process.

Follow the steps to fill out the application accurately and efficiently.

- Press the ‘Get Form’ button to access the application form and open it in an editable format.

- Begin by entering your full name in the designated field.

- Provide your complete address, including street number and name.

- Fill in your city, state, and zip code in the appropriate boxes.

- Input your Social Security number or Federal Identification number.

- Select the type of return you intend to file by marking the corresponding box and make sure to attach the appropriate Federal extension form: Federal Form 4868 for individual returns, or Federal Form 7004 for partnerships and corporations.

- Indicate the taxable year or fiscal year for which the extension is being requested.

- Specify the date until which you are requesting the extension to file your Big Rapids Income Tax Return, ensuring it does not exceed six months.

- In the tax liability section, enter the amount you estimate as your liability.

- Detail your record of credits, including any overpayments from the prior year, estimated tax payments, and withholding for the current year. Calculate the total credits.

- Determine the balance due by subtracting your total credits from your tax liability.

- Completing the section on interest and penalties, acknowledge that an extension does not provide additional time to pay taxes owed.

- Finally, provide your signature, designation (if applicable), and the date of completion.

- Print or save your completed application for your records before submitting it.

Complete your application for extension online today to ensure you meet your filing requirements.

Use Form 5209 for individual city filing extensions or Form 5301 for city corporate extensions. Individual and Fiduciary filers submit Form 4 or a copy of your federal extension. An extension of time to file the federal return automatically extends the time to file the Michigan return to the new federal due date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.