Loading

Get Loss Mitigation Opt-out Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LOSS MITIGATION OPT-OUT FORM online

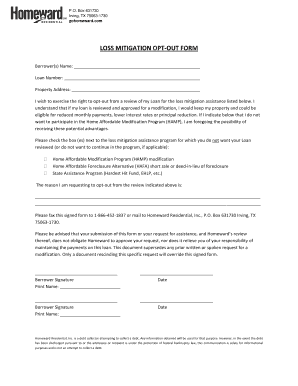

Filling out the Loss Mitigation Opt-Out Form online is an essential process for borrowers wishing to decline participation in specific loss mitigation programs. This guide will walk you through each section of the form to ensure clarity and ease of submission.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, fill in the 'Borrower(s) Name' field with your full legal name as it appears on your loan documents.

- Next, enter your 'Loan Number' in the specified field to identify your loan uniquely.

- Fill in the 'Property Address' field with the complete address of the property associated with the loan.

- Review the statement regarding your decision to opt-out from loss mitigation assistance. Acknowledge the implications of this decision.

- In the selection section, check the boxes next to any loss mitigation assistance programs from which you wish to opt-out. The options include HAMP modification, HAFA short sale or deed-in-lieu of foreclosure, and state assistance programs.

- Provide a brief explanation for your request to opt-out in the designated space, detailing any specific reasons you wish to include.

- Sign the form using your legal signature. Ensure this is done in both signature fields provided for each borrower.

- Print your name and include the date next to your signature to validate the form.

- Review the form for accuracy, then save your changes. Choose to download the form to your device, print it for mailing, or share it as necessary.

Complete your loss mitigation opt-out form online today!

Loss mitigation refers to the steps mortgage servicers take to work with a mortgage borrower to avoid foreclosure . Loss mitigation refers to a servicer's responsibility to reduce or “mitigate” the loss to the investor that can come from a foreclosure. Certain loss-mitigation options may help you stay in your home.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.