Loading

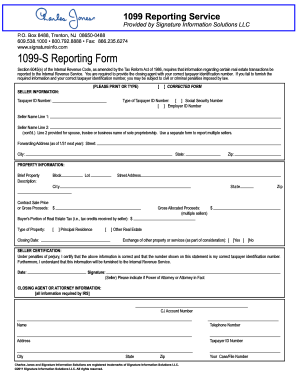

Get Charles Jones Reporting Service 1099-s Reporting Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Charles Jones Reporting Service 1099-S Reporting Form online

The Charles Jones Reporting Service 1099-S Reporting Form is essential for reporting real estate transactions to the Internal Revenue Service. This guide provides clear, step-by-step instructions on how to successfully complete the form online.

Follow the steps to complete the 1099-S Reporting Form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Seller Information' section, enter the taxpayer identification number. Indicate whether this is a social security number or an employer ID number.

- Fill in the seller's name on the first line. If applicable, use the second line for the spouse, trustee, or business name of a sole proprietorship.

- Provide the forwarding address using the fields for street, city, state, and zip code, as of January 31 of the next year.

- In the 'Property Information' section, write a brief description of the property being sold. Include details such as block, lot, street address, city, state, and zip code.

- Enter the contract sale price or gross proceeds for the property, along with any gross allocated proceeds if there are multiple sellers.

- Add the buyer's portion of real estate tax, including any tax credits received by the seller.

- Select the type of property by checking the appropriate box for either principal residence or other real estate. Provide the closing date.

- Indicate if there was an exchange of other property or services as part of the consideration by checking 'Yes' or 'No.'

- In the 'Seller Certification' section, sign and date the form, certifying that the information provided is accurate and complete. If you are signing as an Attorney in Fact or Power of Attorney, indicate this appropriately.

- Complete the 'Closing Agent or Attorney Information' section by filling in all required information, including the CJ account number, phone number, address, taxpayer ID number, and any case/file number.

- Once all sections are completed, review the information for accuracy, then save changes, download, print, or share the form as needed.

Complete your 1099-S Reporting Form online today for a smooth filing experience.

Related links form

Generally, if you sell your house, you will receive a 1099-S to report the sale to the IRS. However, certain exceptions may apply based on the circumstances of the sale. If you question whether you'll receive one, consider checking with your settlement agent and using Charles Jones Reporting Service 1099-S Reporting Form for further guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.