Loading

Get Social Security 360 Analyzer

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Social Security 360 Analyzer online

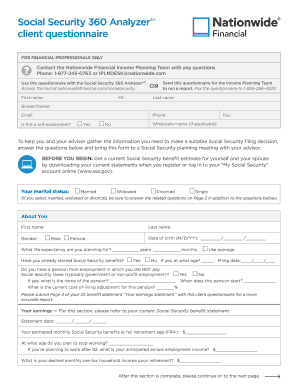

The Social Security 360 Analyzer is a vital tool designed to help individuals plan for their Social Security benefits effectively. This guide offers step-by-step instructions on how to complete the form online, ensuring that you have all the necessary information to optimize your benefits.

Follow the steps to successfully complete the Social Security 360 Analyzer.

- Press the ‘Get Form’ button to access the questionnaire, making sure to have all required personal information ready.

- Begin by entering your personal details, including your first name, last name, middle initial, broker/dealer information, email address, and phone number. Indicate whether this is a self-assessment.

- Select your marital status from the options provided: married, widowed, divorced, or single. If applicable, be prepared to answer related questions on subsequent pages.

- Fill out the section titled 'About You', entering information such as gender, date of birth, planned life expectancy, and whether you have started receiving Social Security benefits.

- Provide details regarding your pension, if relevant, including the name of the pension and its start date. Include current cost-of-living adjustments.

- Complete the earnings section, which requires you to refer to your current Social Security benefit statement for accurate estimates.

- After finishing your section, repeat the above steps for the 'About your spouse' section, ensuring to gather the necessary details about your spouse's earnings and pension status.

- If you are widowed or divorced, address the appropriate questions to assess any survivor or spousal benefits to which you may be entitled.

- Finalize your questionnaire by reviewing all information entered for accuracy. If required, submit any additional documentation or earnings statements.

Get started on your Social Security planning by completing the Social Security 360 Analyzer online today.

Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.