Get Ph Bir 1905 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 1905 online

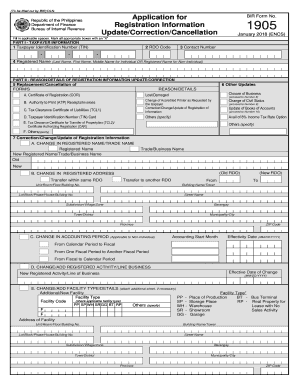

Filling out the BIR Form No. 1905 is essential for registering updates or correcting information related to your taxpayer registration. This guide will provide clear, step-by-step instructions on how to complete the form online, ensuring that users without extensive legal experience can easily manage their submission requirements.

Follow the steps to successfully complete the PH BIR 1905 online.

- Press the ‘Get Form’ button to access the PH BIR 1905 form online and open it for editing.

- Fill out Part I, which contains taxpayer information. Enter your Taxpayer Identification Number (TIN), RDO code, contact number, and the registered name as it appears in your documents. Ensure accuracy in all spaces provided.

- Move on to Part II: Reason/Details of Registration Information Update/Correction. Here, indicate the applicable reason based on your situation by marking the appropriate boxes. Ensure that you provide additional details as needed for the chosen options.

- For any changes to your registered name or address, complete the respective sections under Part II. Include both old and new information where prompted.

- If applicable, provide details about any change in your accounting period or business activity. Specify effective dates and register new activities as required.

- Complete the section related to the closure of business or cancellation of registration if it pertains to your situation. Provide necessary dates and justifications where asked.

- In the Declaration section, ensure you agree to the declaration prerequisite and fill in your details as the taxpayer or authorized representative.

- Finally, review all entries for correctness. Save your changes, then download, print, or share the completed form as needed.

Complete your documents online now to ensure timely updates and compliance.

Related links form

You can download new BIR forms by visiting the 'Forms' section on the official BIR website, where they regularly update all necessary documents. Additionally, third-party platforms like USLegalForms can assist in providing these forms in a user-friendly manner. This is particularly useful for anyone accustomed to PH BIR 1905, ensuring you have the latest versions for your tax needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.