Get Canada Tarn-30dy 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada TARN-30DY online

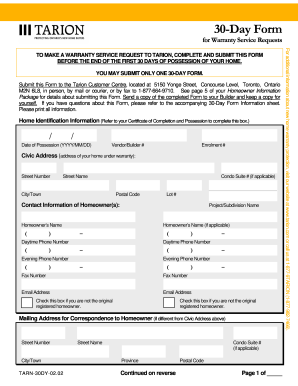

Filling out the Canada TARN-30DY is an essential step for homeowners to report warranty items within the first 30 days of possession of their new home. This guide provides a professional and supportive overview of each component of the form to ensure accurate completion and timely submission.

Follow the steps to effectively complete the Canada TARN-30DY online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your home identification information, including the Date of Possession, Vendor/Builder #, and Enrolment #. Refer to your Certificate of Completion and Possession for this information.

- Fill in the civic address of your home under warranty, making sure to include the street number, street name, city or town, condo suite number (if applicable), postal code, and lot number.

- Provide your contact information, including names of homeowners, daytime and evening phone numbers, fax number, and email address.

- If you are not the original registered homeowner, be sure to check the appropriate box.

- In the Outstanding Items section, list all warranty items that need to be reported. Make sure to include thorough descriptions of each item and specify the room or location.

- If applicable, check the box to report any issues with the air conditioning system and provide additional details.

- Sign the form to confirm the accuracy of the reported items. If there is a second homeowner, they should also sign.

- Number the pages of the form in the bottom right corner and ensure that all sections are complete.

- Submit the completed form to Tarion, either in person, by mail, or by fax. Be sure to send a copy of the form to your builder and retain a copy for your records.

Begin filling out your Canada TARN-30DY online today to ensure you meet the submission deadline.

Get form

Related links form

To file a zero corporate tax return in Canada, you must complete a T2 return, even if your corporation has no income. Be sure to indicate that there was no business activity during the year. The Canada TARN-30DY provides a useful framework for filling out these forms correctly. If you need assistance, uslegalforms can offer templates and guidance tailored to your situation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.