Loading

Get Commercial Employer Account Registration And Update Form De 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Commercial Employer Account Registration And Update Form DE 1 online

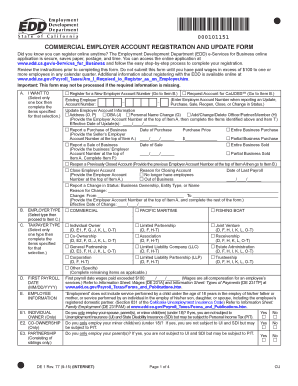

The Commercial Employer Account Registration And Update Form DE 1 is an essential document for employers in California, whether registering a new account or updating existing information. This guide will walk you through the steps to complete the form online effectively.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Select one box in section A indicating your intention, such as registering for a new employer account or updating existing information. Complete the specified items based on your selection.

- In section B, choose your employer type by selecting the box that best describes your business structure.

- In section C, select the taxpayer type that applies to your business and complete any required items listed.

- Enter the first payroll date in section D using the MM/DD/YYYY format.

- For section E, provide employee information based on your business structure, completing items E1, E2, or E3 as applicable.

- In section F, indicate the location of your employee services, specifically whether they work in or outside California.

- If applicable, fill out section G with details of individual owners or co-owners including names and identification numbers.

- In section H, list corporate officers or partners, entering necessary details such as names, titles, and identification information.

- Provide your business's legal name in section I, as stated in registration documents, and fill out section J for any DBA (Doing Business As) name.

- Complete section K with your Federal Employer Identification Number (FEIN) or state 'Applied For' if you have yet to receive one.

- Enter your business's date of ownership initiation in section L and fill in your California Secretary of State entity number in section N.

- In section O, provide your business's physical location with a complete street address.

- Fill out the mailing address in section P where official correspondence should be sent.

- Enter a valid email address in section Q and indicate if you wish to receive communications via email.

- Detail your industry activity in section R, describing your business's products or services.

- In section S, provide contact information for the authorized person responsible for communications related to the employer account.

- Finally, in section T, sign the declaration confirming the accuracy of your submitted information, along with your name, title, and date.

- Once the form is completed, save your changes, and choose to download or print the document for your records.

Get started on your Commercial Employer Account Registration And Update Form DE 1 online today.

Register for an Employer Payroll Tax Account Number Create a username and password. Go to e-Services for Business. Select Enroll. Enter the required information and select Continue. ... Log in to e-Services for Business. Select New Customer. Select Register for Employer Payroll Tax Account Number.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.