Loading

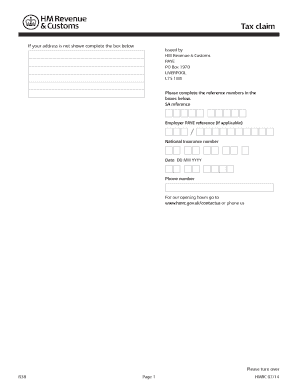

Get R38 - Tax Claim Use Form R38 To Claim A Tax Refund When You Have Overpaid Tax And To Authorise A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R38 - Tax Claim Use Form R38 To Claim A Tax Refund When You Have Overpaid Tax And To Authorise A online

Filling out the R38 form is a crucial process for individuals seeking a tax refund due to overpayment. This guide will provide clear, step-by-step instructions to ensure you accurately complete the form and submit it for processing.

Follow the steps to complete your tax claim form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- Begin filling in your personal details at the top of the form. Ensure that all sections, such as your address, surname, first name(s), postcode, and National Insurance number, are completed in capital letters.

- In the reference numbers section, provide any applicable reference numbers such as your SA reference and employer PAYE reference if relevant.

- Indicate the date of your claim in the specified format (DD MM YYYY). This is essential for processing your request.

- Fill out the claimant details section, including the addresses. Make sure to sign where indicated to authenticate your claim.

- If applicable, specify the period concerning the overpayment by indicating the start and end dates in the given format (From DD MM YYYY to DD MM YYYY).

- If you completed a Self Assessment tax return and want the refund directed to a bank or building society account, fill in the name and address of your nominee, as well as their account details.

- Alternatively, if you do not complete a Self Assessment tax return, you will receive your repayment via a payable order. Ensure you nominate someone with a bank account to receive this, if necessary.

- Complete the authority section by indicating whether you authorize a nominee or an agent to receive the amount due on your behalf. Fill in the name of the account holder and the branch sort code for the receiving account.

- Once you have filled in all required fields, make sure to review the form for accuracy. Save your changes and prepare to print or share your completed form.

Complete your documents online today to expedite your tax refund process.

6 Ways to Get a Bigger Tax Refund Try itemizing your deductions. Double check your filing status. Make a retirement contribution. Claim tax credits. Contribute to your health savings account. Work with a tax professional.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.